Rising Security Concerns

The increasing concerns regarding public safety and security in China are driving the demand for the video surveillance-storage market. With urbanization and population density on the rise, cities are becoming more vulnerable to crime and unrest. As a result, both public and private sectors are investing heavily in surveillance systems to enhance security measures. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the heightened focus on safety, prompting organizations to adopt advanced video surveillance solutions that require robust storage capabilities. The video surveillance-storage market is thus positioned to benefit from this trend, as the need for reliable and scalable storage solutions becomes increasingly critical.

Growing Demand for Data Security

As data breaches and cyber threats become more prevalent, the demand for data security in the video surveillance-storage market is intensifying. Organizations are increasingly aware of the vulnerabilities associated with storing sensitive surveillance data, prompting them to seek advanced security measures. This trend is particularly pronounced in sectors such as finance, healthcare, and critical infrastructure, where data integrity is paramount. The market is witnessing a shift towards solutions that offer encryption, secure access controls, and compliance with data protection regulations. It is estimated that the demand for secure storage solutions could account for nearly 30% of the overall market by 2027, highlighting the importance of data security in shaping the future of the video surveillance-storage market.

Government Initiatives and Investments

Government initiatives aimed at enhancing public safety and urban management are playing a pivotal role in the growth of the video surveillance-storage market. In recent years, the Chinese government has launched various programs to integrate smart city technologies, which include extensive surveillance systems. These initiatives often come with substantial funding, leading to increased procurement of surveillance equipment and storage solutions. Reports indicate that government spending on security infrastructure is expected to reach approximately $20 billion by 2026. This influx of investment not only boosts the video surveillance-storage market but also encourages private sector participation, creating a synergistic effect that further propels market growth.

Integration of IoT in Surveillance Systems

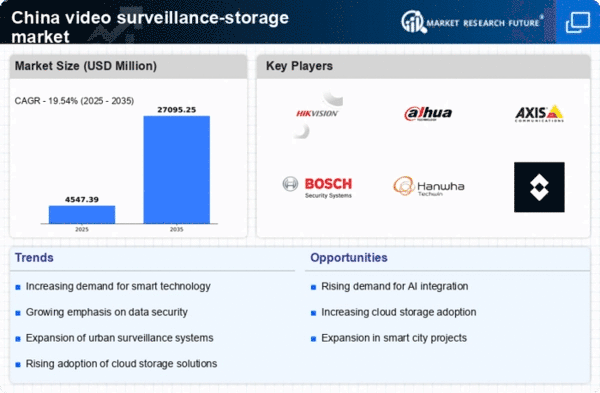

The integration of Internet of Things (IoT) technologies into surveillance systems is emerging as a key driver for the video surveillance-storage market. IoT-enabled devices facilitate real-time monitoring and data collection, leading to an exponential increase in the volume of video data generated. This trend is particularly relevant in smart cities, where interconnected devices work collaboratively to enhance security and operational efficiency. The video surveillance-storage market is adapting to this shift by offering scalable storage solutions that can handle the increased data load. Analysts predict that the adoption of IoT in surveillance could lead to a market growth rate of around 20% over the next few years, underscoring the transformative impact of IoT on the video surveillance-storage market.

Technological Advancements in Surveillance

Technological innovations in surveillance equipment are significantly impacting the video surveillance-storage market. The introduction of high-definition cameras, advanced analytics, and smart technologies has transformed the landscape of video surveillance. These advancements not only improve the quality of surveillance footage but also increase the volume of data generated, necessitating enhanced storage solutions. For instance, the shift towards 4K resolution cameras has led to a surge in data storage requirements, with estimates suggesting that storage needs could increase by up to 50% compared to standard definition systems. Consequently, the video surveillance-storage market is experiencing a surge in demand for high-capacity storage solutions that can accommodate the growing data influx while ensuring quick access and retrieval.