Focus on Energy Efficiency

China's commitment to sustainability and energy efficiency is influencing the system on-module market. The government has set ambitious targets to reduce energy consumption across various sectors, which encourages the adoption of energy-efficient technologies. In 2025, energy-efficient solutions are expected to account for over 30% of the total electronics market in China. This shift indicates a growing preference for system on-module solutions that offer lower power consumption and enhanced performance. Consequently, the system on-module market is likely to see increased demand as manufacturers align their products with these energy efficiency goals, potentially leading to innovations in design and functionality.

Expansion of Smart Manufacturing

The push towards smart manufacturing in China is significantly impacting the system on-module market. As industries adopt automation and advanced manufacturing techniques, the need for integrated and efficient modules becomes paramount. The smart manufacturing sector is anticipated to grow at a CAGR of around 15% through 2025, highlighting the increasing reliance on sophisticated technologies. This trend suggests that the system on-module market will experience heightened demand as manufacturers seek to implement smart solutions that enhance productivity and reduce operational costs. The integration of system on-module technologies into manufacturing processes may lead to improved product quality and faster time-to-market.

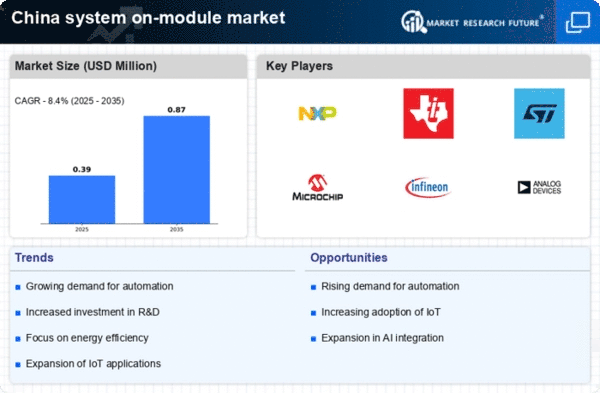

Rising Adoption of IoT Solutions

The increasing integration of Internet of Things (IoT) technologies within various sectors in China is driving the system on-module market. As industries seek to enhance operational efficiency and connectivity, the demand for compact and efficient modules rises. In 2025, the IoT market in China is projected to reach approximately $200 billion, indicating a robust growth trajectory. This trend suggests that manufacturers are likely to invest in system on-module solutions to facilitate seamless communication between devices. The system on-module market is thus positioned to benefit from this surge in IoT adoption, as companies look for reliable and scalable solutions to meet their connectivity needs.

Government Initiatives and Funding

The Chinese government is actively promoting the development of advanced technologies, including those related to the system on-module market. Various initiatives and funding programs are being introduced to support research and development in this sector. In 2025, government investments in technology are expected to exceed $50 billion, with a significant portion allocated to electronics and embedded systems. This financial backing indicates a favorable environment for innovation within the system on-module market. As a result, companies may find increased opportunities to develop cutting-edge solutions that cater to the evolving needs of various industries, thereby driving market growth.

Growing Demand for Consumer Electronics

The consumer electronics sector in China is experiencing robust growth, which is positively influencing the system on-module market. With rising disposable incomes and a growing middle class, the demand for advanced consumer electronics is on the rise. In 2025, the consumer electronics market is projected to reach approximately $150 billion, creating a substantial opportunity for system on-module solutions. This trend suggests that manufacturers are likely to seek compact and efficient modules to meet consumer expectations for performance and functionality. Consequently, the system on-module market is expected to thrive as it aligns with the increasing demand for innovative consumer electronics.