Rising Demand for IoT Solutions

The increasing adoption of Internet of Things (IoT) technologies in South Korea is driving the system on-module market. As industries seek to enhance connectivity and automation, the demand for compact and efficient modules rises. In 2025, the IoT market in South Korea is projected to reach approximately $10 billion, indicating a robust growth trajectory. This trend necessitates the integration of system on-modules, which provide essential functionalities in a small footprint. The system on-module market is thus positioned to benefit from this surge, as manufacturers focus on developing innovative solutions that cater to the specific needs of IoT applications. Furthermore, the proliferation of smart devices and the push for smart city initiatives further amplify the demand for these modules, suggesting a promising outlook for the industry in the coming years.

Advancements in Semiconductor Technology

The system on-module market is significantly influenced by advancements in semiconductor technology. South Korea, being a leader in semiconductor manufacturing, has seen substantial investments in research and development. In 2025, the semiconductor market is expected to grow by 15%, which directly impacts the system on-module market. Enhanced semiconductor capabilities allow for the production of smaller, more powerful modules that can support complex applications. This evolution not only improves performance but also reduces energy consumption, aligning with the growing emphasis on efficiency. As manufacturers leverage these technological advancements, the system on-module market is likely to experience increased competitiveness and innovation, fostering a dynamic environment for growth.

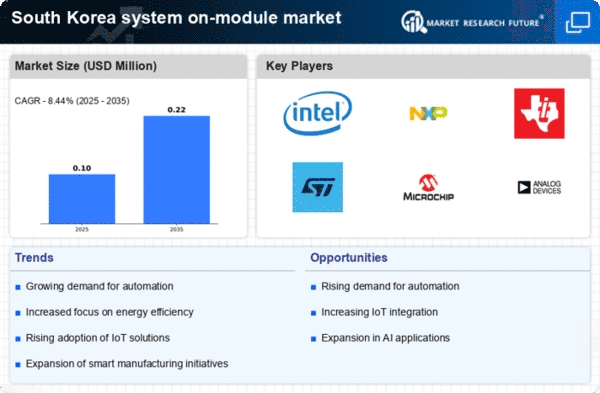

Growing Focus on Automation in Manufacturing

The push towards automation in South Korea's manufacturing sector is a key driver for the system on-module market. As industries strive to enhance productivity and reduce operational costs, the integration of automated systems becomes essential. In 2025, the automation market in South Korea is projected to reach $5 billion, highlighting the increasing reliance on automated solutions. System on-modules play a crucial role in this transformation, providing the necessary computing power and connectivity for automated processes. The system on-module market is thus poised to capitalize on this trend, as manufacturers seek to implement advanced technologies that streamline operations and improve efficiency. This growing focus on automation not only supports economic growth but also positions the industry for sustained demand.

Increased Investment in Smart Infrastructure

The South Korean government's commitment to developing smart infrastructure is significantly impacting the system on-module market. With investments exceeding $3 billion in smart city projects, there is a heightened demand for advanced technologies that facilitate connectivity and data management. System on-modules are integral to these initiatives, enabling the deployment of smart sensors and devices that enhance urban living. The system on-module market stands to benefit from this trend, as municipalities and private sectors collaborate to create intelligent environments. This investment in smart infrastructure not only drives demand for system on-modules but also fosters innovation, as companies strive to develop solutions that meet the evolving needs of urban populations.

Emerging Applications in Healthcare Technology

The system on-module market is experiencing growth due to emerging applications in healthcare technology. South Korea's healthcare sector is increasingly adopting advanced technologies to improve patient care and operational efficiency. In 2025, the healthcare technology market is expected to grow by 20%, creating opportunities for system on-modules that support medical devices and telehealth solutions. These modules enable the integration of sophisticated functionalities in compact formats, essential for modern healthcare applications. The system on-module market is thus likely to see increased demand as healthcare providers seek innovative solutions that enhance service delivery and patient outcomes. This trend not only reflects the evolving landscape of healthcare but also underscores the potential for growth within the system on-module market.