Increased Investment in R&D

Investment in research and development (R&D) within the system on-module market in Germany is witnessing a significant uptick. Companies are allocating substantial resources to innovate and enhance their product offerings, aiming to meet the evolving demands of various industries. This focus on R&D is crucial for developing cutting-edge technologies that can improve performance, efficiency, and integration capabilities. In 2025, it is estimated that R&D spending in the electronics sector will reach approximately €5 billion, reflecting a commitment to advancing system on-module solutions. This investment not only fosters innovation but also positions German manufacturers as leaders in the global market, potentially increasing their market share and influence.

Growing Adoption of IoT Solutions

The proliferation of Internet of Things (IoT) devices is significantly impacting the system on-module market in Germany. As industries increasingly adopt IoT solutions, the demand for integrated modules that can support connectivity and data processing is on the rise. This trend is particularly evident in sectors such as smart home technology, industrial automation, and healthcare. By 2026, it is projected that the number of IoT devices in Germany will exceed 1 billion, creating a substantial market opportunity for system on-module manufacturers. The ability to provide compact, efficient, and reliable modules that facilitate IoT applications is becoming a key differentiator in the competitive landscape.

Rising Demand for Miniaturization

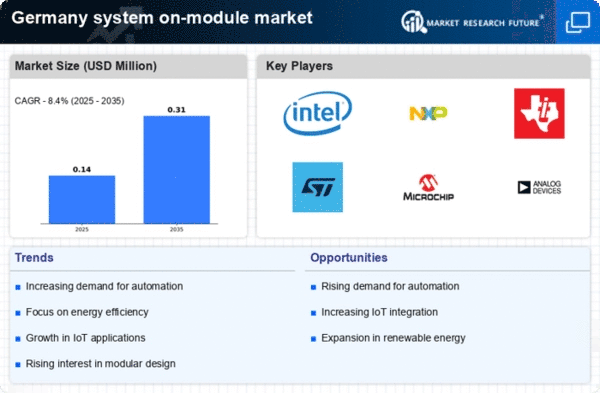

The system on-module market in Germany is seeing a surge in demand for miniaturization across sectors like consumer electronics and automotive applications. As devices become increasingly compact, manufacturers are seeking solutions that integrate multiple functionalities into smaller form factors. This trend is driven by the need for lightweight and space-efficient designs, which are essential in modern technology. The market for miniaturized systems is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust appetite for innovative solutions. Consequently, companies in the system on-module market are focusing on developing advanced packaging technologies that facilitate this miniaturization trend, thereby enhancing their competitive edge.

Emerging Applications in Automotive Sector

The automotive sector in Germany is adopting system on-module solutions due to the need for advanced functionalities in vehicles. With the rise of electric vehicles (EVs) and autonomous driving technologies, there is a growing demand for integrated systems that can manage complex functionalities such as battery management, navigation, and connectivity. The automotive industry is projected to invest approximately €15 billion in electronic components by 2026, indicating a robust market for system on-module products. This trend presents a significant opportunity for manufacturers to innovate and provide tailored solutions that meet the specific requirements of the automotive sector, thereby enhancing their competitive positioning.

Shift Towards Automation and Smart Manufacturing

The system on-module market in Germany is benefiting from a broader shift towards automation and smart manufacturing practices. As industries strive to enhance productivity and reduce operational costs, the integration of advanced technologies into manufacturing processes is becoming essential. This shift is characterized by the adoption of modular systems that can be easily integrated into existing infrastructures. The German manufacturing sector is expected to invest over €10 billion in automation technologies by 2027, which will likely drive demand for system on-module solutions that support these initiatives. Consequently, manufacturers are focusing on developing versatile modules that can adapt to various automation needs, thereby enhancing their market presence.