Surge in Data Traffic

The fiber optic-components market in China is significantly influenced by the surge in data traffic driven by the proliferation of digital services. With the increasing adoption of cloud computing, streaming services, and IoT devices, data consumption is projected to rise by over 30% annually. This escalating demand for bandwidth necessitates the deployment of advanced fiber optic technologies, which are capable of handling large volumes of data efficiently. Consequently, companies operating in the fiber optic-components market are likely to see heightened demand for their products, as network operators seek to upgrade their infrastructure to accommodate this growing data traffic.

Increased Focus on Smart Cities

The fiber optic-components market in China is benefiting from the increased focus on developing smart cities. As urbanization accelerates, local governments are investing in smart infrastructure that relies heavily on fiber optic technology for connectivity. Projects aimed at enhancing public services, traffic management, and energy efficiency are driving the demand for fiber optic components. It is estimated that investments in smart city initiatives could exceed $300 billion by 2030, creating a substantial market for fiber optic solutions. This trend suggests that companies in the fiber optic-components market will find ample opportunities to supply the necessary technology to support these ambitious urban development projects.

Rising Adoption of 5G Technology

The fiber optic-components market in China is poised for growth due to the rising adoption of 5G technology. As telecommunications companies invest heavily in 5G infrastructure, the demand for fiber optic components is expected to increase significantly. The Chinese government has set ambitious targets for 5G rollout, aiming for over 600,000 base stations by the end of 2025. This expansion will require extensive fiber optic networks to support the high-speed and low-latency requirements of 5G services. As a result, manufacturers in the fiber optic-components market are likely to experience a surge in orders, positioning them favorably in a rapidly evolving technological landscape.

Growing Demand for High-Quality Communication

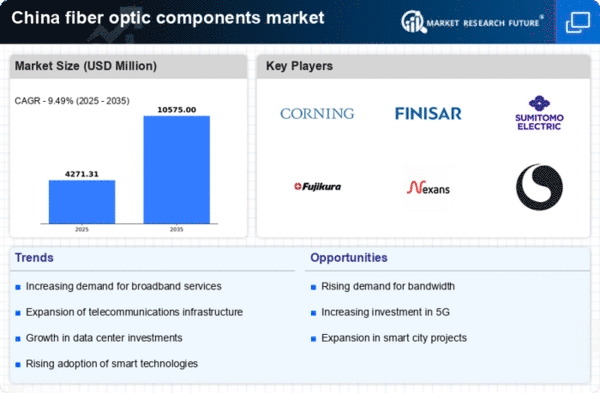

The fiber optic-components market in China is experiencing growth due to the increasing demand for high-quality communication solutions. As businesses and consumers alike seek faster and more reliable internet connections, the need for advanced fiber optic technologies becomes more pronounced. The market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for enhanced communication capabilities. This trend is particularly evident in sectors such as education, healthcare, and finance, where high-speed connectivity is crucial. Consequently, manufacturers in the fiber optic-components market are likely to capitalize on this demand, leading to innovations and improvements in product offerings.

Government Initiatives for Digital Infrastructure

The fiber optic-components market in China is experiencing a boost due to various government initiatives aimed at enhancing digital infrastructure. The Chinese government has allocated substantial funding, estimated at over $100 billion, to develop high-speed internet access across urban and rural areas. This investment is likely to drive demand for fiber optic components, as they are essential for building robust telecommunications networks. Furthermore, the government's commitment to achieving nationwide broadband coverage by 2025 indicates a sustained focus on expanding fiber optic networks. As a result, manufacturers in the fiber optic-components market are expected to benefit from increased orders and long-term contracts, fostering growth in this sector.