Increased Internet Usage

The fiber optic-components market in Canada experiences a notable boost. This is due to the rising internet usage across various sectors. With more individuals and businesses relying on high-speed internet for daily operations, the demand for fiber optic components has surged. As of 2025, approximately 90% of Canadian households have internet access, with a significant portion utilizing fiber optic technology for enhanced connectivity. This trend is likely to continue, as the need for reliable and fast internet becomes increasingly critical for remote work, online education, and digital services. Consequently, the fiber optic-components market is poised for growth, driven by the necessity for robust infrastructure to support this escalating demand.

Emergence of 5G Technology

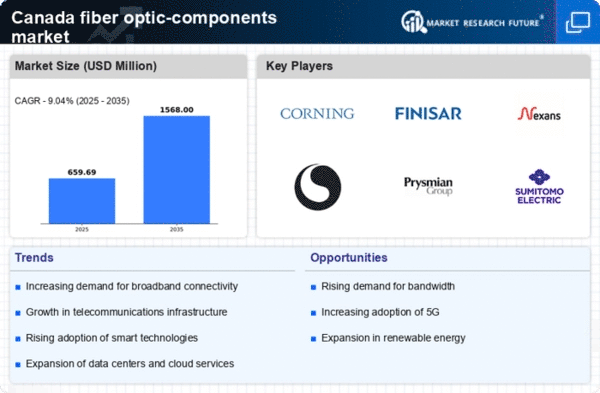

The rollout of 5G technology in Canada is poised to have a profound impact on the fiber optic-components market. 5G networks require extensive fiber optic infrastructure to support their high-speed capabilities and low latency. As telecommunications companies prepare for the widespread adoption of 5G, investments in fiber optic components are expected to rise significantly. By 2025, the Canadian government and private sector are projected to invest over $2 billion in 5G infrastructure, which will likely drive demand for fiber optic technology. This transition not only enhances connectivity but also positions the fiber optic-components market for substantial growth in the coming years.

Investment in Smart Cities

The development of smart cities in Canada is a pivotal driver for the fiber optic-components market. Municipalities are investing heavily in digital infrastructure to enhance urban living, which includes the deployment of fiber optic networks. These networks facilitate efficient communication, traffic management, and public safety systems. As of 2025, Canadian cities are projected to allocate over $1 billion towards smart city initiatives, with a significant portion directed towards fiber optic technology. This investment not only improves the quality of life for residents but also creates a substantial market opportunity for fiber optic components, as cities seek to modernize their infrastructure.

Growing Demand for Data Centers

The fiber optic-components market in Canada is significantly influenced by the increasing demand for data centers. As businesses generate and store vast amounts of data, the need for efficient data transmission becomes paramount. Fiber optic technology offers the high bandwidth and low latency required for modern data centers. In 2025, the Canadian data center market is expected to grow by approximately 15%, further driving the demand for fiber optic components. This growth is indicative of a broader trend towards digital transformation across industries, necessitating advanced fiber optic solutions to support the infrastructure required for data management and storage.

Telecommunications Sector Expansion

The expansion of the telecommunications sector in Canada serves as a crucial driver for the fiber optic-components market. Telecommunications companies are increasingly upgrading their networks to accommodate the growing demand for high-speed internet and mobile services. As of 2025, it is estimated that over 70% of telecom investments will focus on fiber optic technology, reflecting a shift towards more efficient and reliable communication systems. This expansion not only enhances service delivery but also creates a robust market for fiber optic components, as providers seek to improve their infrastructure to meet consumer expectations.