Expansion of Chemical Manufacturing

The Chemical Injection Pumps Market is benefiting from the expansion of the chemical manufacturing sector. As the production of specialty chemicals and polymers increases, the need for precise chemical dosing systems becomes critical. Chemical injection pumps are integral to various processes, including polymerization and blending, ensuring that the correct amounts of additives are introduced at the right time. Recent statistics indicate that the chemical manufacturing industry is projected to grow at a rate of 4% annually, further driving the demand for reliable and efficient chemical injection pumps.

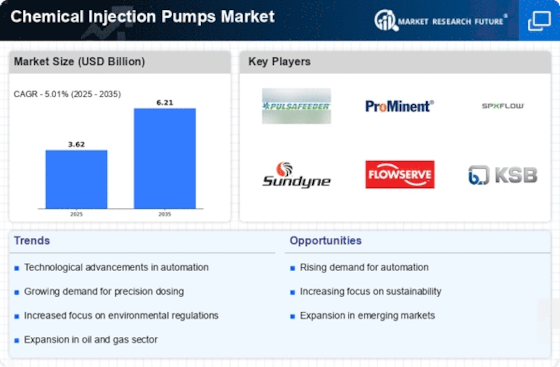

Rising Demand in Oil and Gas Sector

The Chemical Injection Pumps Market is experiencing a notable surge in demand, particularly from the oil and gas sector. As exploration and production activities expand, the need for efficient chemical injection systems becomes paramount. These pumps are essential for the injection of chemicals that enhance oil recovery and maintain pipeline integrity. Recent data indicates that the oil and gas industry accounts for a substantial share of the chemical injection pumps market, with projections suggesting a compound annual growth rate of approximately 5% over the next few years. This growth is driven by the increasing complexity of extraction processes and the necessity for reliable chemical management solutions.

Emergence of Smart Pump Technologies

The Chemical Injection Pumps Market is on the cusp of transformation with the emergence of smart pump technologies. These innovations incorporate IoT and data analytics, allowing for real-time monitoring and control of chemical injection processes. Such advancements not only enhance operational efficiency but also provide valuable insights into system performance and maintenance needs. Market trends suggest that the adoption of smart technologies in chemical injection pumps could lead to a 15% increase in efficiency and a reduction in downtime. This shift towards intelligent systems is likely to reshape the landscape of the chemical injection pumps market.

Growth in Water Treatment Applications

The Chemical Injection Pumps Market is witnessing significant growth in water treatment applications. As water quality regulations become more stringent, industries are compelled to adopt advanced chemical dosing systems to ensure compliance. Chemical injection pumps play a crucial role in the treatment of wastewater and the disinfection of drinking water. Market analysis reveals that the water treatment segment is expected to grow at a rate of around 6% annually, driven by urbanization and the rising population. This trend underscores the importance of chemical injection pumps in maintaining public health and environmental standards.

Increased Focus on Process Optimization

The Chemical Injection Pumps Market is increasingly influenced by the focus on process optimization across various sectors. Industries are seeking to enhance operational efficiency and reduce costs, leading to a greater reliance on automated chemical injection systems. These systems not only improve accuracy in chemical dosing but also minimize waste and environmental impact. Data suggests that companies implementing advanced chemical injection solutions can achieve up to 20% reductions in operational costs. This trend is likely to propel the demand for chemical injection pumps, as businesses strive for more sustainable and efficient production methods.