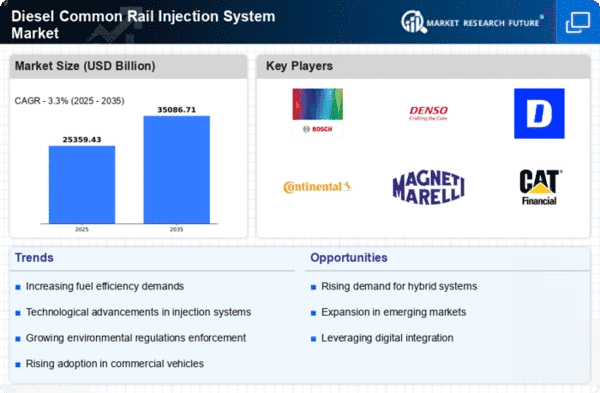

Market Growth Projections

The Global Diesel Common Rail Injection System Market Industry is projected to experience substantial growth in the coming years. With an estimated market value of 24549.3 USD Billion in 2024, the industry is expected to expand at a CAGR of 6.27% from 2025 to 2035, potentially reaching 47925.1 USD Billion by 2035. This growth is indicative of the increasing demand for advanced diesel injection systems across various sectors, including automotive, agriculture, and construction. The market's expansion reflects the ongoing innovations in diesel technology and the rising emphasis on fuel efficiency and emissions reduction.

Increasing Demand for Fuel Efficiency

Growing concerns regarding fuel consumption and environmental impact are propelling the Global Diesel Common Rail Injection System Market Industry. As consumers and industries alike prioritize fuel efficiency, diesel engines equipped with common rail systems are favored for their ability to deliver higher mileage. This trend is particularly evident in the automotive and commercial vehicle sectors, where regulations are becoming increasingly stringent. The market is expected to grow at a CAGR of 6.27% from 2025 to 2035, reaching an estimated value of 47925.1 USD Billion by 2035. This demand for fuel-efficient solutions is likely to stimulate further innovations in diesel injection technologies.

Regulatory Compliance and Emission Standards

The Global Diesel Common Rail Injection System Market Industry is significantly influenced by stringent regulatory compliance and emission standards imposed by governments worldwide. Regulations aimed at reducing nitrogen oxide and particulate matter emissions are driving manufacturers to adopt advanced diesel injection technologies. For example, the Euro 6 standards in Europe have necessitated the development of cleaner diesel engines, which rely heavily on common rail systems for optimal performance. As these regulations become more stringent, the demand for advanced diesel injection systems is expected to rise, thereby propelling market growth and innovation in the sector.

Rising Adoption of Clean Diesel Technologies

The Global Diesel Common Rail Injection System Market Industry is witnessing a rising adoption of clean diesel technologies as manufacturers strive to meet environmental standards. Technologies such as selective catalytic reduction and exhaust gas recirculation are being integrated with common rail systems to minimize emissions. This shift towards cleaner diesel solutions is not only driven by regulatory pressures but also by consumer preferences for environmentally friendly vehicles. As the market evolves, the integration of these technologies is expected to enhance the appeal of diesel engines, thereby supporting market growth and innovation.

Technological Advancements in Injection Systems

The Global Diesel Common Rail Injection System Market Industry is experiencing rapid technological advancements that enhance fuel efficiency and reduce emissions. Innovations such as piezoelectric injectors and advanced electronic control units are being integrated into diesel engines, leading to improved performance. For instance, the introduction of multi-injection strategies allows for finer control of fuel delivery, optimizing combustion. This trend is likely to drive market growth as manufacturers seek to comply with stringent emission regulations and improve engine performance. The market is projected to reach 24549.3 USD Billion in 2024, indicating a robust demand for advanced diesel injection technologies.

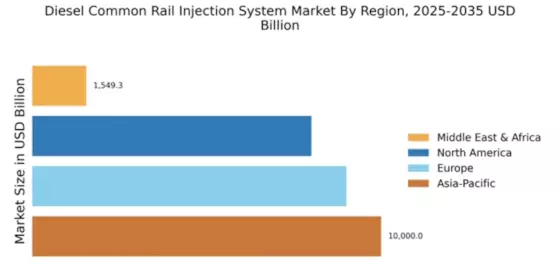

Expansion of Automotive and Commercial Vehicle Sectors

The expansion of the automotive and commercial vehicle sectors is a key driver for the Global Diesel Common Rail Injection System Market Industry. As emerging economies continue to industrialize, the demand for commercial vehicles is surging, leading to increased adoption of diesel engines. This trend is particularly pronounced in regions such as Asia-Pacific and Latin America, where infrastructure development is underway. The growing automotive sector, coupled with the need for efficient transportation solutions, is likely to boost the demand for diesel common rail systems. This growth trajectory is expected to contribute to the overall market expansion in the coming years.