Growing Investment in Cancer Research

The Cell Cycle Analysis Market is witnessing a surge in investment directed towards cancer research. As the global burden of cancer continues to rise, funding from both public and private sectors is increasingly allocated to understanding the mechanisms of cell proliferation and apoptosis. This investment is crucial for developing novel therapeutic strategies and improving existing treatments. In recent years, funding for cancer research has seen an increase of approximately 5% annually, which is expected to continue. This influx of resources is likely to drive advancements in cell cycle analysis technologies, thereby expanding the Cell Cycle Analysis Market.

Rising Demand for Personalized Medicine

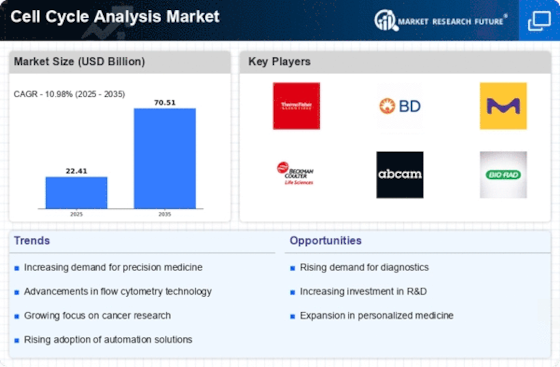

The Cell Cycle Analysis Market is significantly influenced by the rising demand for personalized medicine. As healthcare shifts towards tailored treatment plans, understanding the cell cycle becomes essential for developing targeted therapies. This trend is particularly evident in oncology, where cell cycle analysis aids in identifying specific biomarkers that can predict patient responses to treatments. The market for personalized medicine is expected to grow at a compound annual growth rate of over 10% in the coming years, further propelling the need for advanced cell cycle analysis techniques. Consequently, this demand is likely to stimulate innovation and investment in the Cell Cycle Analysis Market.

Increased Focus on High-Throughput Screening

The Cell Cycle Analysis Market is benefiting from an increased focus on high-throughput screening methods. These techniques allow researchers to analyze thousands of samples simultaneously, significantly accelerating the pace of discovery in drug development and basic research. The ability to conduct large-scale studies efficiently is becoming a critical factor for pharmaceutical companies and academic institutions alike. As a result, the market for high-throughput screening technologies is projected to grow substantially, with estimates suggesting a value of over 10 billion USD by 2027. This trend is likely to enhance the demand for cell cycle analysis tools and services within the Cell Cycle Analysis Market.

Emerging Applications in Regenerative Medicine

The Cell Cycle Analysis Market is expanding due to emerging applications in regenerative medicine. As researchers explore the potential of stem cells and tissue engineering, understanding the cell cycle becomes vital for optimizing cell growth and differentiation. The regenerative medicine sector is projected to grow at a compound annual growth rate of around 8% over the next decade, indicating a robust interest in this field. This growth is likely to create new opportunities for cell cycle analysis tools and methodologies, thereby enhancing the overall landscape of the Cell Cycle Analysis Market.

Technological Advancements in Cell Cycle Analysis Tools

The Cell Cycle Analysis Market is experiencing a surge in technological advancements that enhance the precision and efficiency of cell cycle studies. Innovations such as flow cytometry, imaging cytometry, and advanced software for data analysis are becoming increasingly prevalent. These technologies allow researchers to obtain more accurate and reproducible results, which is crucial for understanding cellular processes. The market for flow cytometry alone is projected to reach approximately 5 billion USD by 2026, indicating a robust growth trajectory. As these tools become more sophisticated, they enable researchers to conduct more complex analyses, thereby driving demand within the Cell Cycle Analysis Market.