Rising Focus on Drug Development

The cell cycle-analysis market is benefiting from a heightened focus on drug development, particularly in the oncology sector. Pharmaceutical companies in the US are increasingly investing in research to develop targeted therapies that disrupt specific phases of the cell cycle. This trend is likely to drive demand for cell cycle-analysis tools that can provide critical data on drug efficacy and mechanism of action. The market for cell cycle analysis is projected to grow as more companies recognize the importance of understanding cell cycle dynamics in drug development. It is estimated that the market could reach $1 billion by 2027, reflecting the growing integration of cell cycle analysis in the drug discovery process. This focus on drug development is expected to significantly impact the cell cycle-analysis market.

Growing Cancer Research Initiatives

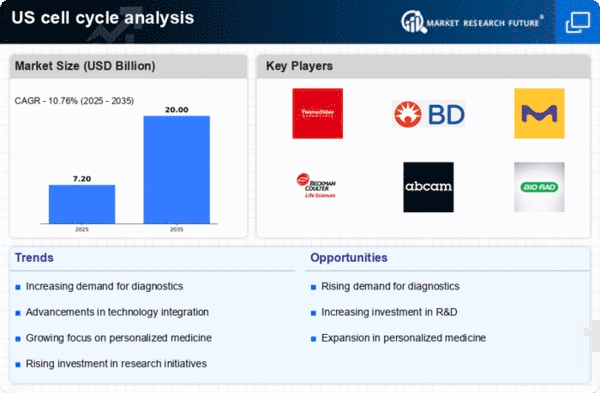

The cell cycle-analysis market is experiencing growth due to increased funding and initiatives aimed at cancer research. In the US, the National Cancer Institute has allocated substantial resources to understand cancer biology, which includes studying cell cycle dynamics. This focus on cancer research is likely to drive demand for advanced cell cycle-analysis tools and technologies. As researchers seek to identify novel therapeutic targets, the need for precise cell cycle analysis becomes paramount. The market is projected to expand as institutions invest in cutting-edge technologies, potentially leading to a CAGR of around 10% over the next five years. This trend indicates a robust future for the cell cycle-analysis market, as it aligns with the broader goals of improving cancer treatment outcomes.

Increased Adoption of Flow Cytometry

Flow cytometry has emerged as a critical technology in the cell cycle-analysis market, particularly in the US. This technique allows for rapid analysis of cell populations, providing insights into cell cycle phases and health. The adoption of flow cytometry is likely to increase as laboratories seek efficient and accurate methods for cell analysis. According to recent estimates, the flow cytometry segment is expected to capture a significant share of the market, potentially exceeding 30% by 2026. This growth is driven by advancements in flow cytometry technology, including the development of multi-parameter analysis capabilities, which enhance the understanding of cell cycle regulation. As a result, the cell cycle-analysis market is poised for substantial growth, fueled by the demand for flow cytometry solutions.

Emergence of Advanced Imaging Techniques

The cell cycle-analysis market is witnessing a transformation with the emergence of advanced imaging techniques. Technologies such as live-cell imaging and high-content screening are becoming increasingly prevalent in research settings across the US. These techniques allow for real-time observation of cell cycle progression, providing invaluable insights into cellular behavior. The integration of imaging technologies into cell cycle analysis is likely to enhance the accuracy and depth of research findings. As researchers demand more sophisticated tools, the market for cell cycle analysis is expected to expand, potentially growing at a rate of 8% annually. This trend indicates a shift towards more dynamic and comprehensive approaches to studying cell cycles, thereby influencing the overall landscape of the cell cycle-analysis market.

Growing Demand for Biomarkers in Diagnostics

The cell cycle-analysis market is experiencing a surge in demand for biomarkers that can aid in diagnostics, particularly in cancer detection. As the understanding of cell cycle regulation deepens, researchers are identifying specific biomarkers associated with various stages of the cell cycle. This trend is likely to drive the development of diagnostic tools that utilize cell cycle biomarkers, enhancing early detection and personalized treatment strategies. The market for cell cycle analysis is projected to grow as healthcare providers increasingly adopt these diagnostic tools. It is estimated that the biomarker segment could account for over 25% of the overall market by 2026. This growing demand for biomarkers in diagnostics is expected to significantly influence the cell cycle-analysis market.