Market Growth Projections

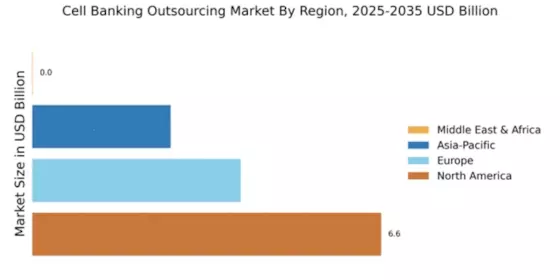

The Global Cell Banking Outsourcing Market Industry is poised for substantial growth, with projections indicating a market size of 3.75 USD Billion in 2024 and an anticipated increase to 18.8 USD Billion by 2035. This trajectory suggests a remarkable compound annual growth rate (CAGR) of 15.78% from 2025 to 2035. Such growth is indicative of the increasing reliance on outsourced cell banking services across various sectors, including biotechnology and pharmaceuticals. The market dynamics reflect a broader trend towards specialization and efficiency, as organizations seek to leverage the expertise of outsourcing partners to enhance their operational capabilities.

Regulatory Support and Compliance

The Global Cell Banking Outsourcing Market Industry benefits from a favorable regulatory environment that encourages outsourcing practices. Regulatory bodies are increasingly recognizing the importance of cell banking in supporting clinical research and therapeutic development. This regulatory support facilitates compliance with stringent quality standards, thereby enhancing the credibility of outsourced cell banking services. Companies are more inclined to outsource their cell banking operations to specialized providers who possess the necessary expertise in navigating complex regulatory landscapes. As regulatory frameworks continue to evolve, the outsourcing of cell banking services is likely to gain traction, ensuring that organizations can focus on their core competencies while adhering to compliance requirements.

Growing Focus on Personalized Medicine

The Global Cell Banking Outsourcing Market Industry is increasingly influenced by the growing focus on personalized medicine. As healthcare shifts towards tailored treatment approaches, the demand for diverse cell types and genetic materials intensifies. Outsourced cell banking services provide the necessary infrastructure to support the development of personalized therapies, ensuring that researchers have access to a wide range of biological materials. This trend is likely to drive market growth, with projections indicating a substantial increase in demand for cell banking services. The ability to customize treatments based on individual patient profiles underscores the importance of outsourcing in facilitating advancements in personalized medicine.

Cost Efficiency and Resource Optimization

Cost efficiency remains a driving factor in the Global Cell Banking Outsourcing Market Industry. By outsourcing cell banking operations, organizations can significantly reduce overhead costs associated with maintaining in-house facilities and personnel. This approach allows companies to allocate resources more effectively, focusing on research and development rather than operational complexities. The potential for cost savings is particularly appealing to small and medium-sized enterprises that may lack the financial capacity to invest in extensive cell banking infrastructure. As the market continues to grow, the emphasis on resource optimization through outsourcing is expected to strengthen, enabling organizations to enhance their operational efficiency while maintaining high-quality standards.

Increasing Demand for Cell-Based Therapies

The Global Cell Banking Outsourcing Market Industry experiences a notable surge in demand for cell-based therapies, driven by advancements in regenerative medicine and personalized healthcare. As the healthcare landscape evolves, the need for reliable cell storage and management solutions becomes paramount. In 2024, the market is projected to reach 3.75 USD Billion, reflecting the growing reliance on cell banks for therapeutic applications. This trend is expected to continue, with projections indicating a market size of 18.8 USD Billion by 2035, suggesting a robust compound annual growth rate (CAGR) of 15.78% from 2025 to 2035. Such growth underscores the critical role of outsourcing in meeting the increasing therapeutic demands.

Technological Advancements in Cell Preservation

Technological innovations play a pivotal role in shaping the Global Cell Banking Outsourcing Market Industry. Enhanced cryopreservation techniques and automated cell processing systems are revolutionizing the way cells are stored and managed. These advancements not only improve the viability of stored cells but also streamline operational efficiencies for outsourcing partners. As a result, organizations are increasingly outsourcing their cell banking needs to leverage these cutting-edge technologies. The integration of artificial intelligence and machine learning in cell banking processes further enhances data management and quality control, positioning outsourcing as a strategic choice for companies aiming to maintain competitive advantages in a rapidly evolving market.