Rising Trade Volumes

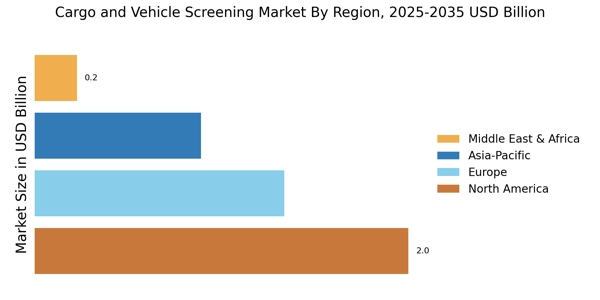

The Cargo and Vehicle Screening Market is poised for growth due to rising trade volumes across various regions. As international trade continues to expand, the need for efficient and effective screening solutions becomes increasingly critical. In 2025, the volume of global trade is expected to surpass USD 30 trillion, necessitating robust screening processes to ensure the security of goods in transit. This surge in trade activities presents a substantial opportunity for the Cargo and Vehicle Screening Market, as businesses seek to enhance their security measures while maintaining operational efficiency. The interplay between rising trade volumes and the need for enhanced security measures is likely to drive innovation and investment in screening technologies.

Technological Advancements

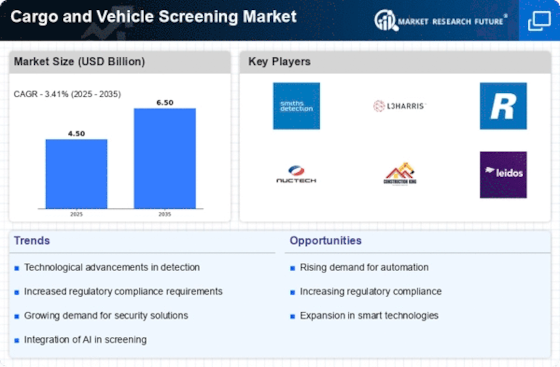

Technological advancements play a pivotal role in shaping the Cargo and Vehicle Screening Market. Innovations such as artificial intelligence, machine learning, and advanced imaging technologies are revolutionizing the way cargo and vehicles are screened. These technologies enhance detection capabilities, reduce false positives, and streamline the screening process. As of 2025, the integration of these technologies is expected to account for a significant portion of the market, with automated systems becoming increasingly prevalent. The ability to analyze vast amounts of data in real-time not only improves efficiency but also enhances the overall effectiveness of security measures, making technological progress a key driver in the Cargo and Vehicle Screening Market.

Increasing Security Concerns

The Cargo and Vehicle Screening Market is experiencing a surge in demand due to escalating security concerns across various sectors. Governments and organizations are increasingly prioritizing the safety of transportation networks, leading to the implementation of stringent screening protocols. In 2025, the market is projected to reach a valuation of approximately USD 5 billion, reflecting a compound annual growth rate of around 6.5%. This growth is driven by the need to mitigate risks associated with terrorism, smuggling, and other illicit activities. Enhanced security measures are not only vital for protecting assets but also for ensuring public safety, thereby reinforcing the importance of advanced screening technologies in the Cargo and Vehicle Screening Market.

Regulatory Compliance Requirements

The Cargo and Vehicle Screening Market is significantly influenced by evolving regulatory compliance requirements. Governments worldwide are enacting stricter regulations to ensure the safety and security of transportation systems. Compliance with these regulations necessitates the adoption of advanced screening technologies, thereby driving market growth. In 2025, it is anticipated that the demand for screening solutions will be bolstered by new regulations aimed at enhancing border security and cargo inspection processes. Organizations that fail to comply with these regulations may face severe penalties, further incentivizing investment in screening technologies. Thus, regulatory compliance emerges as a crucial driver in the Cargo and Vehicle Screening Market.

Growing Awareness of Supply Chain Security

The Cargo and Vehicle Screening Market is benefiting from a growing awareness of supply chain security among businesses and governments. As supply chains become more complex and interconnected, the potential vulnerabilities associated with cargo transport are increasingly recognized. In 2025, organizations are expected to allocate more resources towards securing their supply chains, which includes investing in advanced screening technologies. This heightened focus on security is driven by the need to protect against theft, fraud, and other risks that could disrupt operations. Consequently, the emphasis on supply chain security is likely to propel the demand for screening solutions within the Cargo and Vehicle Screening Market.