Technological Integration

The integration of advanced technologies into the air cargo-security-screening market is a significant driver of growth. Innovations such as artificial intelligence (AI), machine learning, and automated screening systems are enhancing the efficiency and accuracy of cargo inspections. These technologies enable faster processing times and reduce the likelihood of human error, which is crucial in maintaining security standards. The market is witnessing an influx of investments, with companies allocating substantial budgets towards research and development. In 2025, it is estimated that the US market will see an investment increase of around 20% in technology-driven solutions. This technological integration not only improves security but also streamlines operations, making it a vital component of the air cargo-security-screening market.

Increasing Security Threats

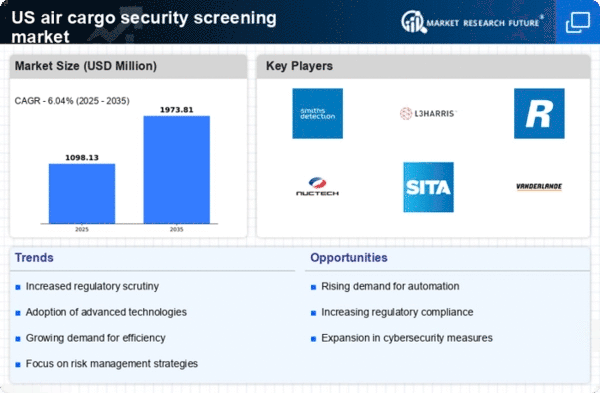

The The air cargo security screening market is experiencing heightened demand due to the increasing security threats faced by the aviation sector. With the rise in global terrorism and smuggling activities, the need for robust security measures has become paramount. In the US, the Transportation Security Administration (TSA) has mandated stricter screening protocols for air cargo, which has led to a surge in the adoption of advanced screening technologies. This trend is reflected in the market's projected growth, with estimates suggesting a compound annual growth rate (CAGR) of approximately 5.5% over the next five years. As security threats evolve, the The air cargo security screening market must adapt. This necessity drives innovation and investment in new technologies to ensure the safety of air cargo operations.

Rising E-commerce Activities

The surge in e-commerce activities is significantly impacting the air cargo-security-screening market. As online shopping continues to grow, the volume of air cargo shipments has increased, necessitating more rigorous security measures. E-commerce companies are increasingly relying on air freight to meet customer demands for fast delivery, which in turn drives the need for efficient and effective security screening processes. In 2025, it is projected that e-commerce will account for over 30% of total air cargo shipments in the US, further emphasizing the importance of robust security protocols. This trend is likely to propel the air cargo-security-screening market, as stakeholders seek to ensure the safe transport of goods while maintaining operational efficiency.

Evolving Regulatory Landscape

The evolving regulatory landscape in the US is a critical driver for the air cargo-security-screening market. Regulatory bodies, including the TSA and the Federal Aviation Administration (FAA), continuously update their guidelines to address emerging threats and enhance security measures. Compliance with these regulations is mandatory for air cargo operators, leading to increased investments in security screening technologies. The market is expected to grow as companies strive to meet these stringent requirements, with a projected increase in compliance-related expenditures of approximately 15% by 2026. This evolving regulatory environment not only drives demand for advanced screening solutions but also fosters innovation within the air cargo-security-screening market.

Public Awareness and Demand for Safety

Public awareness regarding safety and security in air travel is a growing concern, influencing the air cargo-security-screening market. As consumers become more informed about potential risks associated with air cargo, there is an increasing demand for transparency and assurance in security measures. This heightened awareness is prompting air cargo operators to invest in advanced screening technologies and processes to enhance their security protocols. In response to consumer expectations, the market is likely to see a shift towards more comprehensive security solutions, with an anticipated growth in demand for screening services by approximately 10% in the coming years. This trend underscores the importance of maintaining high safety standards within the air cargo-security-screening market.