Market Share

Cardiac Imaging Software Market Share Analysis

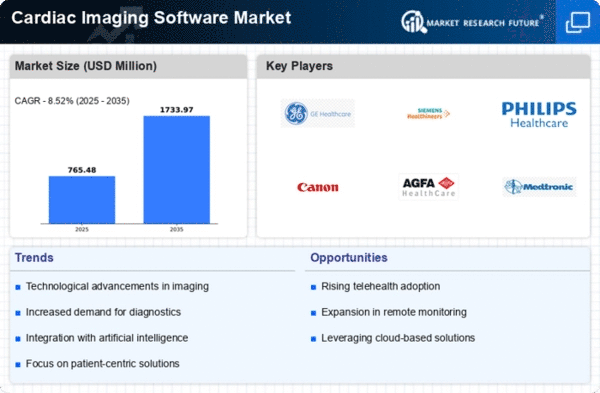

The Cardiac Imaging Software market is a dynamic and rapidly evolving sector within the healthcare industry. As advancements in technology continue to shape medical diagnostics, the market for cardiac imaging software has become highly competitive. The market share positioning is considered to be a key aspect of the Cardiac Imaging Software in Question. It includes long-term planning that has high market share to capture the market visibility and an enemy from competitors. Healthcare organizations are considered strong partners to this company, and forming relationships with them is a technique that the firm can use. Collaborations carry the potential to create exclusive agreements that preclude not only obviously competitive firms but also numerous other actors that lack an appropriate mandate at large communication network of medical facilities, and rigidify their subsets into preferences for a particular software solution despite various fluctuating pressures. Corporations seeking market share enlargement tend to go out and head to the global market. This translates to the ability of marketers to understand different markets distinct requirements and providing for their needs. Translation for software to acceptable languages will contribute in the success of all nations given the fact that it is subjected to regional regulations and different cultural practices. Cardiac imaging system is large enough that there are companies who choose to specialize and focus on cardiac imaging software sector so as target niche markets. To achieve it, companies would concentrate their efforts on the needs of a particular segment of patients, i.e., pediatric cardiac imaging or 3D reconstruction skills and thus gain experience in the field to narrow customer base. Creating broad learning programmes and an efficient customer relationship centre can help in shifting the market share. The hiring of people with the essential job-related skills is facilitated by healthcare providers opting for software solutions that have comprehensive training materials and an efficient, quick to respond support team. Pricing is therefore a primary setting factor for the market share. Companies achieve their competitive and flexible pricing by putting each of the two approaches into practice, especially by introducing subscription-based models or various tiered pricing plans as a way to meet different budgetary needs in healthcare organizations. In the healthcare industry, adherence to regulatory standards and robust data security measures are non-negotiable. Companies that prioritize compliance and invest in state-of-the-art security protocols can build trust among healthcare providers, positively influencing their market share.

Leave a Comment