Growing Geriatric Population

The Global Cardiac Imaging Software Market Industry is also influenced by the growing geriatric population, which is more susceptible to cardiovascular diseases. As individuals age, the risk of heart-related ailments increases, leading to a higher demand for effective diagnostic tools. The elderly population often requires specialized imaging techniques to accurately assess cardiac health. Consequently, healthcare providers are investing in advanced cardiac imaging software to cater to this demographic. This trend is expected to drive market growth, as the geriatric population is projected to continue expanding, further emphasizing the need for innovative imaging solutions.

Increased Healthcare Expenditure

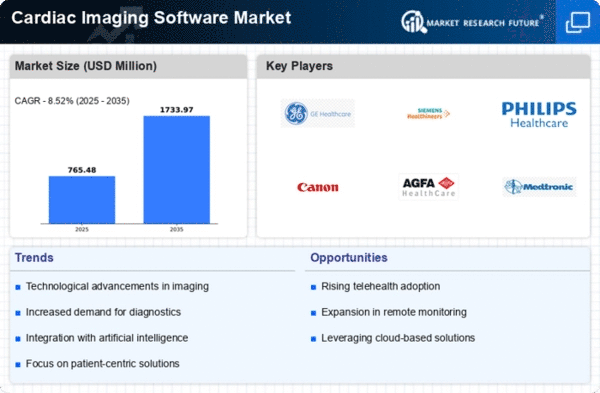

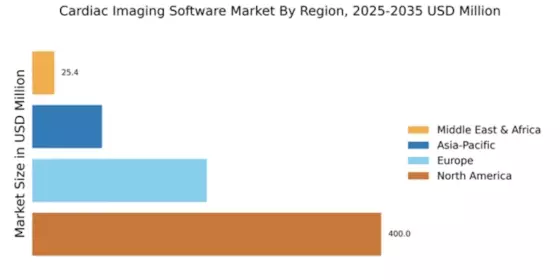

The Global Cardiac Imaging Software Market Industry benefits from increased healthcare expenditure across various regions. Governments and private sectors are allocating more resources to healthcare, particularly in diagnostics and imaging technologies. This financial commitment enables healthcare facilities to acquire advanced cardiac imaging software, thereby improving diagnostic capabilities. Enhanced funding is likely to facilitate research and development in imaging technologies, leading to the introduction of more sophisticated solutions. As healthcare expenditure continues to rise, the market is expected to experience robust growth, aligning with the projected CAGR of 8.47% from 2025 to 2035.

Regulatory Support and Initiatives

The Global Cardiac Imaging Software Market Industry is positively impacted by regulatory support and initiatives aimed at improving cardiac care. Governments and health organizations are implementing policies that promote the adoption of advanced imaging technologies. These initiatives often include funding for research, development, and training programs for healthcare professionals. By fostering an environment conducive to innovation, regulatory bodies are encouraging the integration of advanced cardiac imaging software into clinical practice. This support is likely to enhance the market's growth trajectory, as healthcare providers increasingly adopt these technologies to comply with evolving standards.

Rising Prevalence of Cardiovascular Diseases

The Global Cardiac Imaging Software Market Industry is significantly driven by the rising prevalence of cardiovascular diseases worldwide. According to health statistics, cardiovascular diseases remain a leading cause of morbidity and mortality, necessitating advanced diagnostic tools for effective management. The increasing incidence of conditions such as heart attacks and strokes has led to a heightened demand for cardiac imaging solutions. As healthcare systems strive to enhance patient outcomes, the adoption of sophisticated imaging software is likely to accelerate. This trend is expected to contribute to the market's growth, with projections indicating a rise to 1.74 USD Billion by 2035.

Technological Advancements in Imaging Techniques

The Global Cardiac Imaging Software Market Industry is experiencing rapid growth due to continuous technological advancements in imaging techniques. Innovations such as 3D imaging, artificial intelligence integration, and enhanced visualization tools are revolutionizing cardiac diagnostics. These advancements not only improve the accuracy of diagnoses but also enhance the efficiency of imaging procedures. As a result, healthcare providers are increasingly adopting advanced cardiac imaging solutions, contributing to the market's expansion. The market is projected to reach 0.71 USD Billion in 2024, with a significant increase anticipated as these technologies become more prevalent in clinical settings.