Market Analysis

In-depth Analysis of Cardiac Imaging Software Market Industry Landscape

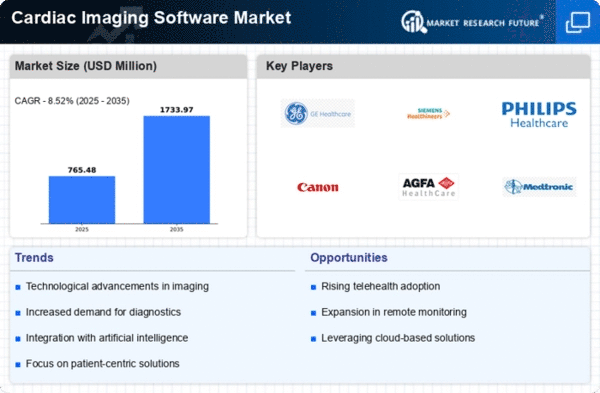

The Cardiac Imaging Software market is witnessing robust growth, driven by the increasing prevalence of cardiovascular diseases worldwide. This software plays a pivotal role in enhancing diagnostic accuracy and treatment planning for cardiac conditions, making it an essential component in modern healthcare. The market share positioning is considered to be a key aspect of the Cardiac Imaging Software in Question. It includes long-term planning that has high market share to capture the market visibility and an enemy from competitors. Cardiac imaging system is large enough that there are companies who choose to specialize and focus on cardiac imaging software sector so as target niche markets. To achieve it, companies would concentrate their efforts on the needs of a particular segment of patients, i.e., pediatric cardiac imaging or 3D reconstruction skills and thus gain experience in the field to narrow customer base. Creating broad learning programmes and an efficient customer relationship centre can help in shifting the market share. The hiring of people with the essential job-related skills is facilitated by healthcare providers opting for software solutions that have comprehensive training materials and an efficient, quick to respond support team. Marketing and branding are very important in the pointed positioning of market share. Effective brand image creation using targeted advertising, representatives at industry events and online presence bolsters market pie growth. The changes in the field of technology are constant, with headway estimation staying significant. Companies that have regular upgrades on its software every time there is a new technology change, along with security system and also performance is then able to retain current customers and gain more for itself. Pricing is therefore a primary setting factor for the market share. Companies achieve their competitive and flexible pricing by putting each of the two approaches into practice, especially by introducing subscription-based models or various tiered pricing plans as a way to meet different budgetary needs in healthcare organizations. A shift toward a patient-centric approach and personalized medicine is influencing the Cardiac Imaging Software market. Tailoring diagnostics and treatment plans based on individual patient characteristics and needs is becoming increasingly important, driving the development of more advanced and patient-specific imaging solutions.

Leave a Comment