Rising Cyber Threats

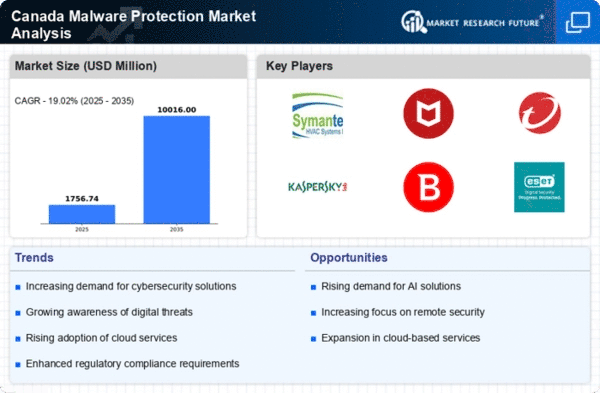

The malware protection market in Canada is experiencing growth due to the increasing frequency and sophistication of cyber threats. Reports indicate that cybercrime incidents have surged, with ransomware attacks becoming particularly prevalent. In 2025, it is estimated that Canadian businesses will face losses exceeding $10 billion due to cyberattacks. This alarming trend compels organizations to invest in robust malware protection solutions to safeguard their sensitive data and maintain operational integrity. As a result, the demand for advanced malware protection technologies is likely to rise, driving market expansion. The malware protection market must adapt to these evolving threats by offering innovative solutions that can effectively counteract the tactics employed by cybercriminals.

Shift to Remote Work

The shift to remote work in Canada has created new vulnerabilities that the malware protection market must address. As more employees work from home, the attack surface for cybercriminals has expanded, leading to a rise in malware incidents targeting remote workers. In 2025, it is projected that over 30% of the Canadian workforce will continue to work remotely, necessitating enhanced security measures. Organizations are increasingly recognizing the need for comprehensive malware protection solutions that can secure remote endpoints and ensure safe access to corporate networks. This trend is likely to drive demand for innovative malware protection technologies tailored for remote work environments, thereby propelling growth in the malware protection market.

Regulatory Compliance Pressure

In Canada, the malware protection market is significantly influenced by the increasing pressure on organizations to comply with stringent regulatory frameworks. The Personal Information Protection and Electronic Documents Act (PIPEDA) mandates that businesses implement adequate security measures to protect personal data. Non-compliance can result in hefty fines, which may reach up to $100,000 for organizations. Consequently, companies are prioritizing investments in malware protection solutions to ensure compliance and avoid potential penalties. This regulatory landscape is driving the growth of the malware protection market, as organizations seek to align their cybersecurity strategies with legal requirements. The malware protection market is thus positioned to benefit from this trend, as compliance-driven investments are likely to increase.

Increased Awareness of Cybersecurity

There is a growing awareness of cybersecurity issues among Canadian businesses, which is positively impacting the malware protection market. As high-profile data breaches make headlines, organizations are becoming more cognizant of the risks associated with inadequate cybersecurity measures. Surveys indicate that approximately 70% of Canadian companies plan to increase their cybersecurity budgets in 2025, with a significant portion allocated to malware protection solutions. This heightened awareness is fostering a proactive approach to cybersecurity, leading to increased investments in advanced malware protection technologies. The malware protection market is likely to benefit from this trend, as organizations seek to fortify their defenses against evolving cyber threats.

Technological Advancements in Security Solutions

The malware protection market in Canada is being driven by rapid technological advancements in security solutions. Innovations such as artificial intelligence (AI) and machine learning (ML) are enhancing the capabilities of malware protection tools, enabling them to detect and respond to threats more effectively. In 2025, it is anticipated that AI-driven malware protection solutions will account for over 40% of the market share, reflecting a shift towards more intelligent and adaptive security measures. As organizations seek to leverage these technologies to improve their cybersecurity posture, the malware protection market is poised for significant growth. The integration of advanced technologies is likely to redefine the landscape of malware protection, making it a critical area of focus for businesses.