Emergence of Edge Computing

The rise of edge computing is reshaping the data center-infrastructure market landscape. As the demand for real-time data processing and low-latency applications increases, organizations in Canada are exploring edge computing solutions. This trend is driven by the proliferation of IoT devices and the need for localized data processing. By 2025, it is projected that edge computing will account for 30% of all data processed, necessitating the development of infrastructure that supports distributed computing environments. This shift presents opportunities for data center providers to expand their offerings and cater to the evolving needs of businesses. The data center-infrastructure market is thus poised to adapt to this emerging paradigm, as companies seek to leverage edge computing for enhanced operational efficiency.

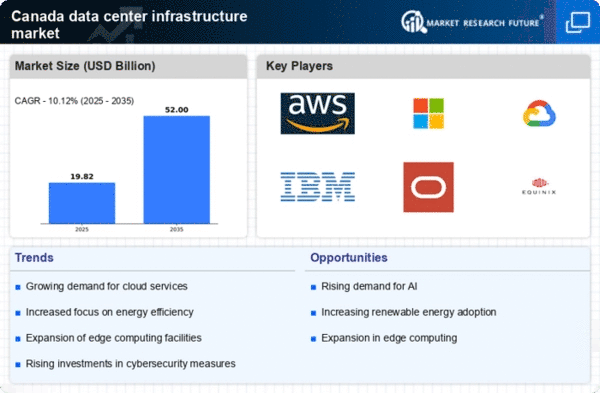

Growing Demand for Cloud Services

The increasing reliance on cloud computing is a pivotal driver for the data center-infrastructure market. As businesses in Canada transition to cloud-based solutions, the demand for robust data center infrastructure intensifies. In 2025, it is estimated that cloud services will account for approximately 70% of IT spending in the country. This shift necessitates the development of scalable and efficient data centers to support the growing volume of data and applications. Consequently, providers are investing heavily in infrastructure upgrades to meet these demands, which is likely to propel the market forward. The data center-infrastructure market is thus positioned to benefit from this trend, as organizations seek to enhance their operational capabilities and ensure seamless access to cloud resources.

Advancements in Cooling Technologies

Innovations in cooling technologies are emerging as a crucial driver for the data center-infrastructure market. As data centers in Canada expand, the need for efficient cooling solutions becomes paramount to manage heat generated by high-density computing. Advanced cooling systems, such as liquid cooling and free-air cooling, are gaining traction due to their potential to reduce energy consumption and operational costs. It is estimated that implementing these technologies can lower cooling energy costs by up to 30%. This shift not only enhances the sustainability of data centers but also aligns with the growing emphasis on energy efficiency within the data center-infrastructure market. As organizations seek to optimize their operations, the adoption of advanced cooling technologies is likely to accelerate.

Regulatory Compliance and Data Sovereignty

In Canada, stringent regulations regarding data protection and privacy are influencing the data center-infrastructure market. Organizations are increasingly required to comply with laws such as the Personal Information Protection and Electronic Documents Act (PIPEDA). This regulatory landscape compels businesses to invest in local data centers to ensure data sovereignty and compliance. As a result, the demand for data center infrastructure that adheres to these regulations is on the rise. It is projected that by 2026, compliance-related investments in data center infrastructure will increase by 25%. This trend underscores the importance of regulatory compliance in shaping the infrastructure landscape, as companies prioritize secure and compliant data storage solutions.

Increased Focus on Disaster Recovery Solutions

The growing awareness of the need for robust disaster recovery solutions is significantly impacting the data center-infrastructure market. Canadian businesses are recognizing the importance of ensuring business continuity in the face of potential disruptions, such as natural disasters or cyberattacks. As a result, investments in data center infrastructure that supports effective disaster recovery strategies are on the rise. It is anticipated that the market for disaster recovery services will grow by 20% annually through 2027. This trend highlights the necessity for organizations to implement resilient infrastructure capable of safeguarding critical data and applications. Consequently, the data center-infrastructure market is likely to see increased demand for solutions that enhance disaster recovery capabilities.