Increasing Use in Abrasives

The Calcined Bauxite Market is witnessing an uptick in the use of calcined bauxite in the abrasives sector. Calcined bauxite is known for its hardness and durability, making it an ideal material for manufacturing abrasives used in grinding, cutting, and polishing applications. The Calcined Bauxite Market is expected to grow at a compound annual growth rate of approximately 5% through 2025, which may lead to an increased demand for calcined bauxite. This growth is likely driven by the rising demand for abrasives in various industries, including automotive, metalworking, and construction. Consequently, the increasing use of calcined bauxite in abrasives could significantly impact the Calcined Bauxite Market.

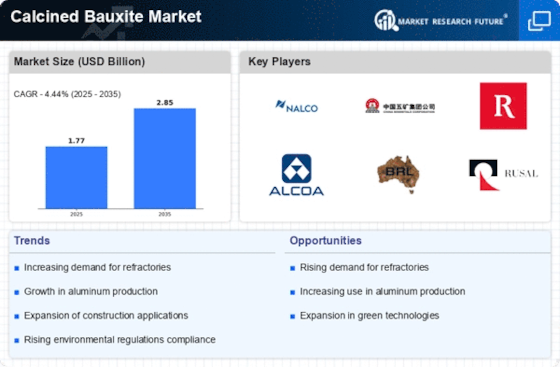

Growth in Aluminum Production

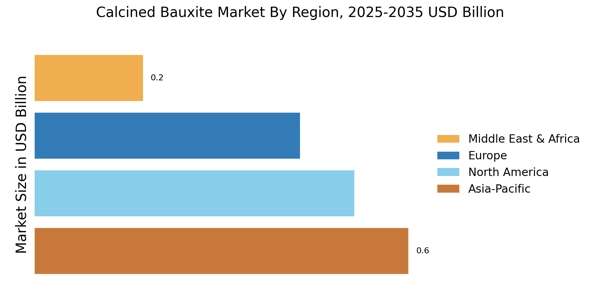

The Calcined Bauxite Market is significantly influenced by the growth in aluminum production. Calcined bauxite serves as a critical raw material in the production of aluminum oxide, which is essential for aluminum smelting. With the increasing demand for aluminum in various sectors, including automotive, aerospace, and construction, the need for calcined bauxite is expected to escalate. Recent data suggests that aluminum production is anticipated to reach around 70 million tons by 2025, thereby driving the demand for calcined bauxite. This trend indicates a strong correlation between aluminum production and the Calcined Bauxite Market, suggesting that as aluminum demand rises, so too will the market for calcined bauxite.

Infrastructure Development Initiatives

Infrastructure development initiatives are playing a pivotal role in shaping the Calcined Bauxite Market. Governments and private sectors are investing heavily in infrastructure projects, including roads, bridges, and buildings, which require high-quality materials for construction. Calcined bauxite is increasingly being utilized in the production of concrete and asphalt, enhancing their durability and performance. As urbanization continues to accelerate, the demand for construction materials is projected to grow, potentially increasing the consumption of calcined bauxite. This trend indicates that the ongoing infrastructure development initiatives could serve as a significant driver for the Calcined Bauxite Market, fostering growth and expansion.

Rising Demand from Refractory Industry

The Calcined Bauxite Market is experiencing a notable surge in demand from the refractory sector. This is primarily due to the increasing need for high-performance materials that can withstand extreme temperatures and corrosive environments. Refractories made from calcined bauxite are essential in steel production, cement manufacturing, and other high-temperature applications. As the global steel production is projected to reach approximately 1.9 billion tons by 2025, the demand for calcined bauxite is likely to rise correspondingly. Furthermore, the shift towards more efficient and sustainable production processes in the refractory industry may further bolster the consumption of calcined bauxite, indicating a robust growth trajectory for the Calcined Bauxite Market.

Environmental Regulations and Sustainability

The Calcined Bauxite Market is also being shaped by stringent environmental regulations and a growing emphasis on sustainability. As industries strive to reduce their carbon footprint, there is a shift towards using more sustainable materials, including calcined bauxite, which is considered a more eco-friendly option compared to synthetic alternatives. The implementation of regulations aimed at reducing emissions in various sectors, such as construction and manufacturing, is likely to drive the demand for calcined bauxite. Furthermore, the industry's commitment to sustainability may lead to innovations in production processes, enhancing the overall appeal of calcined bauxite. This trend suggests that environmental considerations could serve as a significant driver for the Calcined Bauxite Market.