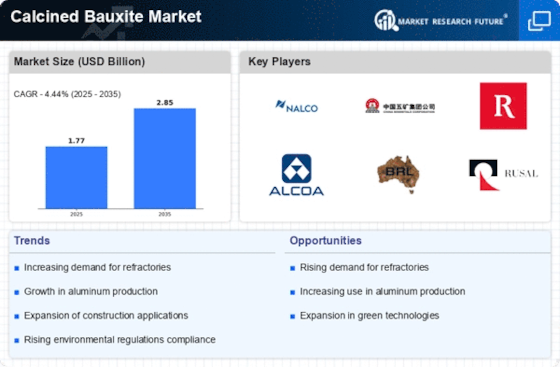

Market Share

Calcined Bauxite Market Share Analysis

The intricate process of calcination involves subjecting a solid chemical compound, such as bauxite ores, to elevated temperatures in an environment devoid of air or with a limited oxygen supply. This thermal treatment serves the crucial purpose of eliminating impurities and volatile substances inherent in the raw material. However, it comes at a significant environmental cost, as the calcination process is known for its high energy intensity, contributing substantially to global greenhouse gas (GHG) emissions. The conventional approach to calcination relies heavily on fossil fuels like coal, petroleum coke, and natural gas to generate the intense heat required for the process.

In recent times, there has been a noteworthy shift in the calcination landscape, driven by two key factors— the escalating production of renewable energy and the consequential decline in renewable energy prices. This shift is steering the industry towards the adoption of electric calcination kilns, marking a departure from the reliance on fossil fuels. Electric calcination kilns revolutionize the process by utilizing electricity to directly heat the materials in an energy-efficient manner. This innovation not only addresses the energy-intensive nature of traditional calcination but also aligns with the global push towards sustainability and reduced carbon emissions.

The use of electric calcination kilns marks a significant advancement in the bauxite calcination industry, offering a more environmentally friendly alternative. By leveraging electricity and, in particular, renewable energy sources, these kilns drastically diminish GHG emissions compared to their traditional counterparts. This reduction in environmental impact is a critical stride towards achieving sustainability goals and mitigating the industry's carbon footprint.

The ongoing transition to electric calcination kilns underscores a broader commitment to greener practices within the bauxite processing sector. As renewable energy becomes increasingly accessible and economically viable, industries have a greater incentive to adopt cleaner technologies. This shift not only aligns with environmental conservation objectives but also positions the bauxite calcination industry as a responsible player in the larger framework of global efforts to combat climate change and promote sustainable industrial practices. As these trends persist, the bauxite calcination sector is poised to contribute positively to a more sustainable and eco-friendly future.

Leave a Comment