Rising Demand for Energy Efficiency

The Global Building Automation System Market Industry experiences a notable surge in demand for energy efficiency solutions. As energy costs continue to rise, building owners and operators are increasingly adopting automation systems to optimize energy consumption. By integrating smart technologies, such as sensors and controls, facilities can reduce energy waste and enhance operational efficiency. This trend is evidenced by the projected market value of 81.7 USD Billion in 2024, indicating a robust growth trajectory. Furthermore, the emphasis on sustainability and compliance with energy regulations further drives the adoption of building automation systems, suggesting a long-term commitment to energy-efficient practices.

Increased Focus on Health and Safety

The increased focus on health and safety within buildings is a driving force in the Global Building Automation System Market Industry. Building owners and managers are prioritizing the implementation of automation systems that enhance indoor air quality, monitor occupancy levels, and ensure compliance with health standards. This heightened awareness of health and safety concerns is leading to the adoption of advanced technologies that facilitate better environmental control. As a result, the market is expected to witness substantial growth, as stakeholders recognize the importance of creating safe and healthy indoor environments for occupants.

Government Initiatives and Regulations

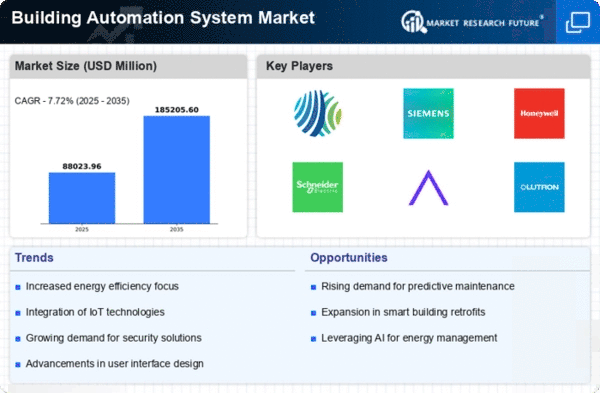

Government initiatives and regulations play a crucial role in shaping the Global Building Automation System Market Industry. Many governments worldwide are implementing policies aimed at promoting energy efficiency and sustainability in buildings. For instance, various countries have established building codes that mandate the integration of automation systems to enhance energy performance. These regulations not only encourage the adoption of building automation technologies but also create a favorable environment for market growth. As a result, the market is projected to reach 185.1 USD Billion by 2035, reflecting the positive impact of regulatory frameworks on the industry's expansion.

Technological Advancements in IoT and AI

Technological advancements in the Internet of Things (IoT) and artificial intelligence (AI) significantly influence the Global Building Automation System Market Industry. The integration of IoT devices allows for real-time monitoring and control of building systems, enhancing operational efficiency and user experience. AI algorithms can analyze data to optimize building performance, predict maintenance needs, and improve occupant comfort. This technological evolution is expected to contribute to the market's growth, with a projected compound annual growth rate (CAGR) of 7.72% from 2025 to 2035. As smart buildings become more prevalent, the demand for advanced automation solutions is likely to increase, further propelling market expansion.

Growing Urbanization and Infrastructure Development

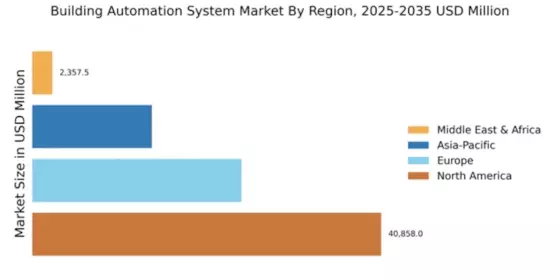

The Global Building Automation System Market Industry is significantly influenced by the trends of urbanization and infrastructure development. As urban populations continue to grow, there is an increasing need for smart buildings that can accommodate the demands of modern living. Building automation systems provide solutions that enhance safety, comfort, and energy efficiency in urban environments. The ongoing infrastructure development projects in emerging economies further drive the demand for advanced automation technologies. This trend suggests a robust market potential, as urbanization is likely to continue shaping the landscape of building automation in the coming years.