Increased Focus on Sustainability

An increased focus on sustainability is emerging as a vital driver in the Europe Building Automation Systems Market. As environmental awareness grows, there is a pressing need for building solutions that reduce carbon footprints and promote sustainable practices. Building automation systems facilitate this by optimizing energy use and integrating renewable energy sources. The market is responding to this demand, with many manufacturers developing systems that align with sustainability goals. This shift not only meets regulatory requirements but also appeals to environmentally conscious consumers, suggesting a promising future for sustainable building automation solutions in the Europe Building Automation Systems Market.

Integration of Smart Technologies

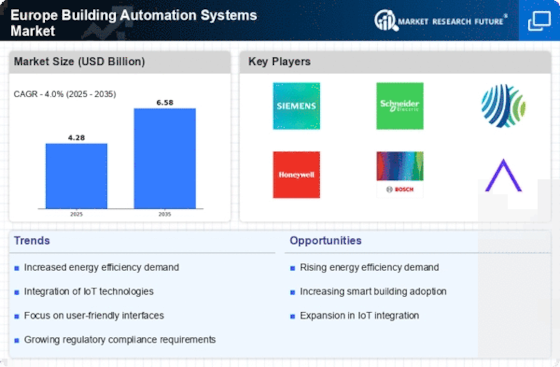

The integration of smart technologies is a pivotal driver in the Europe Building Automation Systems Market. As buildings increasingly adopt advanced technologies, the demand for automation systems that can seamlessly integrate with smart devices is on the rise. This integration enhances operational efficiency and provides real-time data analytics, which are crucial for effective building management. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by the need for improved energy management and enhanced occupant comfort, making smart technology integration a key focus for stakeholders in the Europe Building Automation Systems Market.

Regulatory Compliance and Standards

Regulatory compliance and standards play a crucial role in shaping the Europe Building Automation Systems Market. Governments across Europe are implementing stringent regulations aimed at reducing energy consumption and promoting sustainable building practices. These regulations often mandate the installation of building automation systems to ensure compliance with energy efficiency standards. As a result, the market is witnessing an uptick in demand for systems that not only meet these regulations but also provide advanced functionalities. The European Union's Energy Performance of Buildings Directive is one such regulation that has spurred investment in building automation technologies, indicating a robust growth trajectory for the industry.

Rising Demand for Energy Efficiency

The rising demand for energy efficiency is a significant driver in the Europe Building Automation Systems Market. With increasing energy costs and growing environmental concerns, both commercial and residential sectors are seeking solutions that minimize energy consumption. Building automation systems offer advanced features such as automated lighting, HVAC control, and energy monitoring, which contribute to substantial energy savings. According to recent estimates, buildings equipped with automation systems can achieve energy savings of up to 30%. This trend is likely to continue as more stakeholders recognize the financial and environmental benefits of energy-efficient solutions, further propelling the growth of the Europe Building Automation Systems Market.

Technological Advancements in Automation

Technological advancements in automation are significantly influencing the Europe Building Automation Systems Market. Innovations such as artificial intelligence, machine learning, and advanced data analytics are transforming how building systems operate. These technologies enable predictive maintenance, enhance user experience, and improve overall system efficiency. The market is witnessing a surge in the adoption of these advanced technologies, with projections indicating a substantial increase in market size over the next few years. As building owners and operators seek to leverage these advancements for better performance and cost savings, the Europe Building Automation Systems Market is poised for robust growth.