Increased Focus on Sustainability

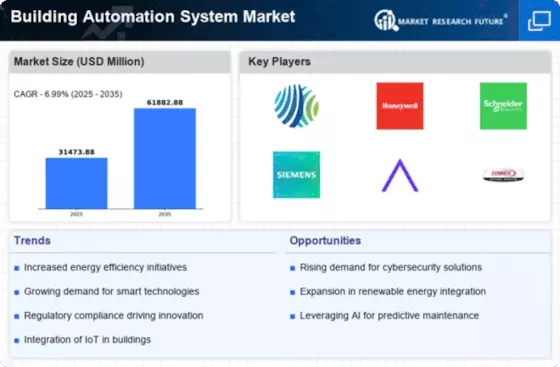

Sustainability has become a pivotal concern in the North America Building Automation System Market, as stakeholders increasingly prioritize environmentally friendly practices. The push for sustainable building solutions is driven by both consumer preferences and corporate responsibility initiatives. Many organizations are adopting building automation systems to monitor and reduce their carbon footprints effectively. For example, LEED certification programs encourage the implementation of energy-efficient technologies, which often include advanced automation systems. The market for sustainable building solutions is projected to grow significantly, with estimates indicating a potential increase of 15% annually. This focus on sustainability not only enhances the appeal of buildings but also aligns with broader environmental goals, thereby propelling the North America Building Automation System Market.

Rising Demand for Smart Buildings

The North America Building Automation System Market is witnessing a notable shift towards smart buildings, driven by the increasing demand for enhanced operational efficiency and occupant comfort. Smart buildings utilize advanced automation systems to optimize energy usage, improve indoor air quality, and enhance security measures. According to recent data, the smart building market in North America is expected to reach USD 100 billion by 2026, indicating a robust growth trajectory. This trend is further fueled by the proliferation of IoT devices and cloud computing technologies, which enable seamless integration of various building systems. Consequently, the North America Building Automation System Market is poised to benefit from this growing inclination towards smart building solutions, as stakeholders seek to leverage technology for improved building performance.

Growing Awareness of Health and Safety

The North America Building Automation System Market is increasingly influenced by the growing awareness of health and safety in building environments. The emphasis on creating healthier indoor spaces has led to the adoption of advanced building automation systems that monitor air quality, lighting, and temperature. Recent studies indicate that improved indoor environmental quality can enhance occupant productivity by up to 15%. As organizations recognize the importance of health and safety, they are more inclined to invest in automation systems that facilitate better control over these factors. This trend is expected to drive market growth, as stakeholders seek to create safer and more comfortable environments for occupants. Consequently, the North America Building Automation System Market is likely to see a sustained increase in demand for health-focused automation solutions.

Regulatory Support for Energy Efficiency

The North America Building Automation System Market is experiencing a surge in demand due to increasing regulatory support for energy efficiency. Governments at both federal and state levels are implementing stringent energy codes and standards, which compel building owners to adopt advanced automation systems. For instance, the U.S. Department of Energy has set ambitious targets for reducing energy consumption in commercial buildings. This regulatory framework not only encourages the integration of building automation systems but also provides financial incentives for compliance. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This regulatory environment fosters innovation and investment in energy-efficient technologies, thereby driving the North America Building Automation System Market forward.

Technological Advancements in Automation

Technological advancements are playing a crucial role in shaping the North America Building Automation System Market. Innovations in artificial intelligence, machine learning, and data analytics are enabling more sophisticated automation solutions that enhance building performance. These technologies allow for real-time monitoring and predictive maintenance, which can significantly reduce operational costs. The integration of AI-driven analytics into building management systems is expected to increase efficiency by up to 30%, according to industry estimates. As these technologies continue to evolve, they are likely to attract more investments and drive the adoption of building automation systems across various sectors. This trend underscores the importance of staying abreast of technological developments in the North America Building Automation System Market.