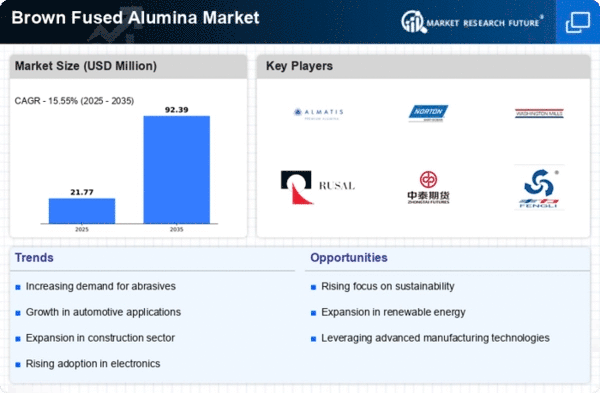

Market Growth Projections

The Global Brown Fused Alumina Market Industry is projected to experience substantial growth over the next decade. With a market value expected to reach 743.5 USD Million in 2024 and an impressive forecast of 1651.7 USD Million by 2035, the industry is poised for significant expansion. The anticipated CAGR of 7.53% from 2025 to 2035 indicates a robust growth trajectory, driven by increasing demand across various sectors such as abrasives, refractories, and ceramics. This growth reflects not only the material's versatility but also its critical role in supporting industrial processes and applications worldwide.

Growth in the Refractory Sector

The Global Brown Fused Alumina Market Industry is significantly influenced by the expanding refractory sector. Brown fused alumina is a critical raw material in the production of refractory products used in high-temperature applications, such as steel and cement manufacturing. As global infrastructure projects and industrial activities ramp up, the demand for refractories is expected to rise. This growth is particularly pronounced in regions with burgeoning industrial bases, where the need for durable and heat-resistant materials is paramount. The increasing focus on energy-efficient production processes further propels the demand for high-quality refractory materials, thereby supporting the market's expansion.

Rising Demand in Abrasive Applications

The Global Brown Fused Alumina Market Industry experiences a robust demand surge due to its extensive use in abrasive applications. Industries such as metalworking, automotive, and construction increasingly rely on brown fused alumina for grinding, cutting, and polishing. The material's hardness and durability make it ideal for producing high-quality abrasives. As the global economy expands, particularly in emerging markets, the demand for efficient and effective abrasive materials is likely to grow. This trend is reflected in the projected market value of 743.5 USD Million in 2024, with expectations to reach 1651.7 USD Million by 2035, indicating a strong growth trajectory fueled by industrial advancements.

Market Dynamics and Competitive Landscape

The Global Brown Fused Alumina Market Industry is characterized by dynamic market conditions and a competitive landscape. With numerous players operating in the market, competition drives innovation and price adjustments. Companies are increasingly focusing on product differentiation and quality enhancement to gain a competitive edge. The presence of both established manufacturers and new entrants creates a vibrant market environment. This competition may lead to strategic partnerships and collaborations aimed at expanding product offerings and market reach. As a result, the market is likely to witness continuous evolution, adapting to changing consumer preferences and technological advancements.

Technological Advancements in Manufacturing Processes

Technological innovations in the production of brown fused alumina significantly enhance the efficiency and quality of the material. The Global Brown Fused Alumina Market Industry benefits from advancements such as improved melting techniques and enhanced purification processes, which lead to higher purity levels and better performance characteristics. These innovations not only reduce production costs but also cater to the increasing quality standards demanded by various industries. As a result, manufacturers are likely to invest in these technologies, driving the market's growth. The anticipated CAGR of 7.53% from 2025 to 2035 further underscores the potential for technological improvements to shape the industry's future.

Environmental Regulations and Sustainability Initiatives

The Global Brown Fused Alumina Market Industry is increasingly shaped by stringent environmental regulations and sustainability initiatives. As industries strive to minimize their ecological footprint, the demand for eco-friendly materials is on the rise. Brown fused alumina, being a recyclable and sustainable product, aligns well with these initiatives. Manufacturers are likely to adopt greener production methods, which not only comply with regulations but also appeal to environmentally conscious consumers. This shift towards sustainability could enhance the market's reputation and broaden its customer base, thereby fostering growth in the coming years.