Rising Focus on Data Analytics

The industrial networking-solutions market in Brazil is witnessing a rising focus on data analytics as companies recognize the value of data-driven decision-making. With the proliferation of connected devices, organizations are generating vast amounts of data that require sophisticated networking solutions for effective analysis. This trend is particularly evident in sectors such as agriculture and energy, where data analytics can lead to improved resource management and operational efficiency. It is estimated that the data analytics market in Brazil will grow by 15% annually, further driving the demand for industrial networking solutions that facilitate seamless data flow and integration.

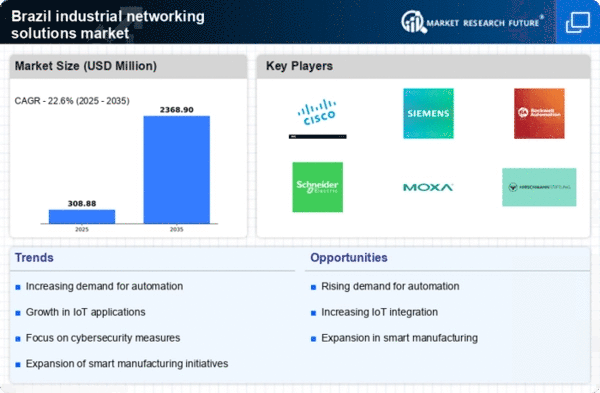

Increased Demand for Automation

The industrial networking-solutions market in Brazil experiences a notable surge in demand for automation technologies. This trend is driven by the need for enhanced operational efficiency and productivity across various sectors, including manufacturing and logistics. As companies strive to optimize their processes, the integration of advanced networking solutions becomes essential. According to recent data, the automation sector in Brazil is projected to grow at a CAGR of 10% over the next five years. This growth is likely to propel the industrial networking-solutions market, as businesses seek to implement smart technologies that facilitate real-time data exchange and improve decision-making capabilities.

Growing Need for Interoperability

Interoperability has emerged as a critical driver for the industrial networking-solutions market in Brazil. As industries adopt diverse technologies and systems, the ability to ensure seamless communication between these systems becomes paramount. This need for interoperability is particularly pronounced in sectors such as automotive and aerospace, where complex supply chains necessitate robust networking solutions. Companies are increasingly investing in technologies that enable different systems to work together efficiently, thereby enhancing overall productivity. The market for interoperability solutions is projected to grow by 12% in Brazil, reflecting the increasing importance of integrated networking solutions.

Investment in Infrastructure Development

Investment in infrastructure development is a key driver for the industrial networking-solutions market in Brazil. The government has been prioritizing infrastructure projects to support economic growth, which includes enhancing connectivity and digital infrastructure. This focus on infrastructure is likely to create opportunities for networking solution providers as industries seek to upgrade their systems to meet modern demands. Recent reports indicate that Brazil's infrastructure spending is expected to reach $100 billion by 2027, which could significantly boost the industrial networking-solutions market as companies look to modernize their operations and improve efficiency.

Expansion of Smart Manufacturing Initiatives

Brazil's industrial networking-solutions market is significantly influenced by the expansion of smart manufacturing initiatives. These initiatives aim to leverage advanced technologies such as artificial intelligence and machine learning to create more efficient production environments. The Brazilian government has been promoting smart manufacturing as part of its industrial policy, which is expected to enhance the competitiveness of local industries. As a result, investments in networking solutions that support these initiatives are likely to increase. The market for smart manufacturing technologies in Brazil is anticipated to reach $5 billion by 2026, indicating a robust opportunity for networking solution providers.