Emergence of Edge Computing

The industrial networking-solutions market is being shaped by the emergence of edge computing, which allows data processing to occur closer to the source of data generation. This shift is driven by the need for reduced latency and improved response times in industrial applications. As more devices become connected, the demand for networking solutions that can support edge computing architectures is increasing. Industries such as manufacturing and transportation are particularly benefiting from this trend, as it enables real-time data processing and decision-making. The edge computing market is expected to grow significantly, potentially reaching $15 billion by 2025, which will likely bolster the industrial networking-solutions market as companies seek to implement these advanced technologies.

Rising Demand for Automation

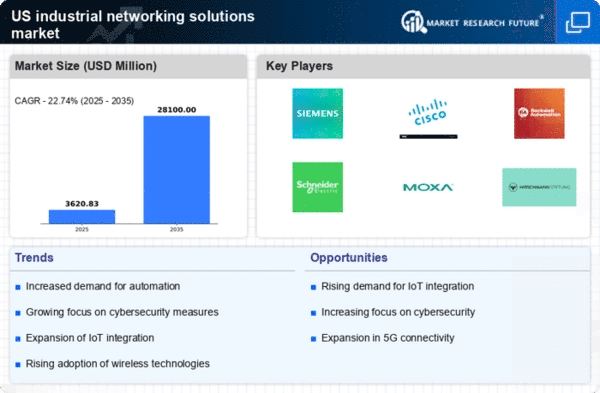

The industrial networking-solutions market is experiencing a notable surge in demand for automation technologies across various sectors. This trend is driven by the need for enhanced operational efficiency and reduced labor costs. Industries such as manufacturing and logistics are increasingly adopting automated systems, which require robust networking solutions to facilitate seamless communication between devices. According to recent data, the automation market in the US is projected to grow at a CAGR of 10% through 2026, indicating a strong correlation with the growth of the industrial networking-solutions market. As companies seek to optimize their processes, the integration of advanced networking solutions becomes essential to support the interconnected nature of automated systems.

Increased Focus on Data Analytics

The industrial networking-solutions market is witnessing a growing emphasis on data analytics as organizations strive to derive actionable insights from their operations. The ability to collect and analyze data in real-time is becoming crucial for decision-making processes. Companies are investing in networking solutions that enable the integration of data from various sources, facilitating advanced analytics capabilities. This trend is particularly evident in sectors such as energy and utilities, where data-driven decisions can lead to significant cost savings and efficiency improvements. The data analytics market in the US is projected to grow to $274 billion by 2022, further underscoring the importance of robust networking solutions in supporting these analytical endeavors.

Growing Regulatory Compliance Requirements

The industrial networking-solutions market is increasingly influenced by growing regulatory compliance requirements across various industries. Organizations are facing stricter regulations regarding data security, privacy, and operational transparency. As a result, there is a heightened demand for networking solutions that can ensure compliance with these regulations. Industries such as healthcare and finance are particularly affected, as they must adhere to stringent standards. The cost of non-compliance can be substantial, prompting companies to invest in reliable networking solutions that facilitate secure data transmission and storage. This trend is expected to drive growth in the industrial networking-solutions market as businesses prioritize compliance in their operational strategies.

Expansion of Smart Manufacturing Initiatives

The industrial networking-solutions market is significantly influenced by the expansion of smart manufacturing initiatives. These initiatives aim to leverage advanced technologies such as AI, machine learning, and big data analytics to enhance production processes. The US government has been promoting smart manufacturing as a means to boost competitiveness and innovation. As a result, investments in networking solutions that support real-time data exchange and analytics are increasing. The smart manufacturing market is expected to reach $300 billion by 2025, which will likely drive demand for sophisticated networking solutions that can handle the complexities of interconnected manufacturing environments.