Focus on Energy Efficiency

Energy efficiency is emerging as a critical driver within the industrial networking-solutions market in Canada. With rising energy costs and increasing environmental regulations, industries are compelled to adopt solutions that minimize energy consumption. The implementation of energy-efficient networking solutions can lead to savings of up to 30% in energy costs. This trend is particularly relevant in sectors such as manufacturing and logistics, where energy usage is substantial. The industrial networking-solutions market is thus likely to see a growing demand for technologies that not only enhance connectivity but also contribute to energy conservation efforts, aligning with broader sustainability objectives.

Integration of 5G Technology

The advent of 5G technology is poised to revolutionize the industrial networking-solutions market in Canada. With its promise of ultra-fast data transmission and low latency, 5G enables the deployment of advanced applications such as remote monitoring and real-time analytics. This technological advancement is expected to drive significant growth in the industrial networking-solutions market, as companies seek to leverage 5G capabilities for enhanced operational efficiency. The potential for 5G to support a higher density of connected devices further underscores its importance in the industrial sector, making it a key driver for future developments in networking solutions.

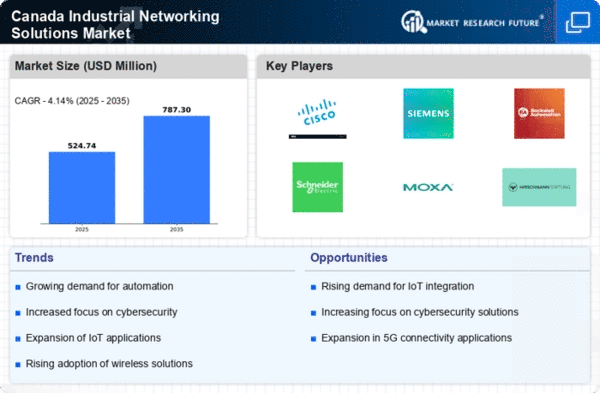

Rising Demand for Automation

The industrial networking-solutions market in Canada experiences a notable surge in demand for automation technologies. As industries strive for enhanced efficiency and productivity, the integration of automated systems becomes paramount. This trend is particularly evident in manufacturing sectors, where automation can lead to a reduction in operational costs by up to 20%. Furthermore, the adoption of automated solutions facilitates real-time data exchange, which is crucial for decision-making processes. The industrial networking-solutions market is thus positioned to benefit from this growing inclination towards automation, as companies seek to streamline operations and improve overall performance.

Expansion of Smart Manufacturing

Smart manufacturing is gaining traction within the industrial networking-solutions market in Canada. This paradigm shift involves the use of advanced technologies such as AI, machine learning, and IoT to create interconnected manufacturing systems. The Canadian government has recognized this trend, investing approximately $1 billion in initiatives aimed at promoting smart manufacturing practices. As a result, the industrial networking-solutions market is likely to see increased demand for robust networking solutions that can support these advanced technologies. The integration of smart manufacturing not only enhances operational efficiency but also contributes to sustainability goals, making it a pivotal driver in the market.

Need for Enhanced Data Analytics

In the context of the industrial networking-solutions market, the necessity for enhanced data analytics capabilities is becoming increasingly apparent. Companies are recognizing the value of data-driven decision-making, which can lead to improved operational efficiency and reduced downtime. The market for data analytics solutions is projected to grow by approximately 25% annually, indicating a strong demand for networking solutions that can facilitate seamless data flow. This trend underscores the importance of integrating advanced analytics into industrial networking systems, as organizations seek to leverage data for competitive advantage. Consequently, the industrial networking-solutions market is poised for growth as businesses invest in analytics-driven networking solutions.