Rising Security Concerns

Brazil has been facing various security challenges, including urban violence and organized crime. These issues have prompted the government and law enforcement agencies to prioritize the safety of personnel, thereby driving demand for protective gear. The combat helmet market is experiencing growth as police and military forces seek to equip their personnel with advanced helmets that offer enhanced protection. The need for improved safety measures is likely to result in an increase in procurement budgets for protective equipment, including combat helmets. This trend suggests a robust market potential as security agencies invest in high-quality helmets to safeguard their personnel in high-risk environments.

Increased Defense Spending

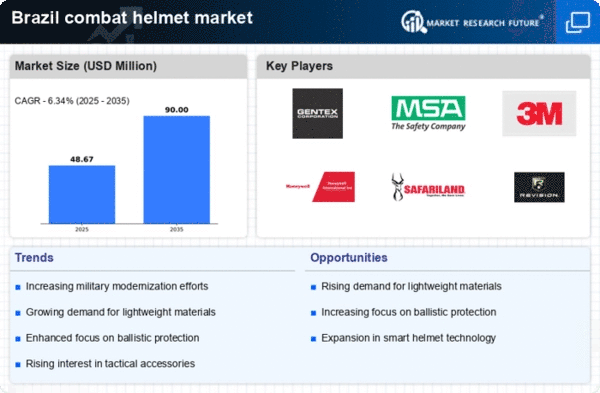

The Brazilian government has been increasing its defense budget, which has a direct impact on the combat helmet market. In recent years, defense spending has risen by approximately 10%, reflecting a commitment to modernizing military equipment. This trend indicates a growing recognition of the importance of advanced protective gear for soldiers. As Brazil seeks to enhance its military capabilities, investments in combat helmets are likely to increase, leading to a more competitive market. The combat helmet market is poised to benefit from this surge in funding, as manufacturers may see higher demand for innovative and effective helmet designs that meet the evolving needs of the armed forces.

Emergence of Local Manufacturers

The combat helmet market in Brazil is witnessing the emergence of local manufacturers who are beginning to produce helmets tailored to the specific needs of the Brazilian military and law enforcement. This shift is significant as it reduces reliance on imported products and fosters domestic innovation. Local companies are likely to focus on developing helmets that incorporate advanced materials and technologies, potentially leading to cost-effective solutions for the armed forces. The presence of local manufacturers may also stimulate competition, driving improvements in quality and performance within the combat helmet market. This trend indicates a growing self-sufficiency in the defense sector, which could enhance the overall market landscape.

Integration of Smart Technologies

The integration of smart technologies into combat helmets is becoming increasingly relevant in Brazil. Innovations such as communication systems, heads-up displays, and environmental sensors are being explored to enhance the functionality of helmets. This trend is indicative of a broader movement within the combat helmet market towards creating multifunctional gear that not only provides protection but also improves situational awareness for users. As military and law enforcement agencies recognize the benefits of these technologies, demand for smart helmets is likely to rise. This could lead to a transformation in the market, with manufacturers focusing on developing helmets that incorporate these advanced features to meet the needs of modern warfare.

Focus on Compliance with Safety Standards

In Brazil, compliance with safety standards is becoming increasingly critical for the combat helmet market. Regulatory bodies are establishing stringent guidelines to ensure that helmets meet specific performance criteria, including impact resistance and ballistic protection. This focus on safety is likely to drive manufacturers to invest in research and development to create helmets that not only comply with regulations but also exceed them. As a result, the market may see a shift towards higher-quality products that offer enhanced protection for users. This trend suggests that adherence to safety standards will play a pivotal role in shaping the competitive landscape of the combat helmet market in Brazil.