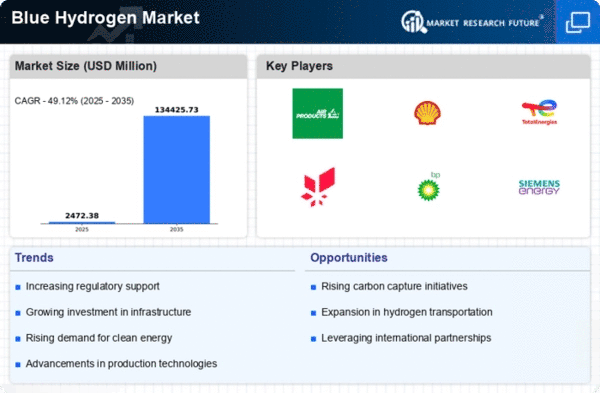

Market Growth Projections

The Global Blue Hydrogen Market Industry is poised for remarkable growth, with projections indicating a market value of 89.5 USD Billion by 2035. This growth trajectory is underpinned by a compound annual growth rate of 46.21% from 2025 to 2035, reflecting the increasing adoption of blue hydrogen across various sectors. The market dynamics are influenced by several factors, including technological advancements, government policies, and rising demand for clean energy solutions. As industries and governments prioritize sustainability, blue hydrogen is likely to play a pivotal role in the global energy landscape, driving significant investments and innovations in the coming years.

Rising Demand for Clean Energy

The Global Blue Hydrogen Market Industry is experiencing a surge in demand for clean energy solutions as countries strive to meet their climate goals. With increasing awareness of climate change and the need for sustainable energy sources, blue hydrogen emerges as a viable alternative. In 2024, the market is valued at approximately 1.37 USD Billion, reflecting a growing interest in hydrogen as a clean fuel. Governments worldwide are implementing policies to support hydrogen production, which is anticipated to drive market growth significantly. This trend indicates a shift towards decarbonization, positioning blue hydrogen as a key player in the global energy transition.

Growing Industrial Applications

The Global Blue Hydrogen Market Industry is witnessing an expansion in industrial applications, particularly in sectors such as refining, ammonia production, and steel manufacturing. Blue hydrogen serves as a critical feedstock in these industries, where it can replace traditional fossil fuels, thus reducing carbon emissions. The demand for hydrogen in refining processes, for instance, is increasing as companies seek to produce cleaner fuels. This trend is further supported by the need for sustainable practices across various industries. As blue hydrogen becomes more integrated into industrial processes, its market share is expected to grow, contributing to the overall expansion of the hydrogen economy.

Government Policies and Incentives

Supportive government policies and incentives play a crucial role in shaping the Global Blue Hydrogen Market Industry. Many governments are implementing frameworks that promote the development and adoption of hydrogen technologies, including blue hydrogen. These policies often include subsidies, tax incentives, and funding for research and development. For instance, various countries have set ambitious hydrogen strategies, aiming to establish themselves as leaders in the hydrogen economy. Such initiatives are expected to stimulate investment and innovation in the sector, thereby accelerating market growth. As a result, the market is projected to reach an impressive value of 89.5 USD Billion by 2035, driven by these favorable regulatory environments.

Increasing Investment in Hydrogen Infrastructure

Investment in hydrogen infrastructure is a key driver of the Global Blue Hydrogen Market Industry. As the demand for hydrogen grows, the need for robust infrastructure to support production, storage, and distribution becomes paramount. Governments and private entities are channeling funds into developing hydrogen hubs and transportation networks, which are essential for facilitating the widespread adoption of blue hydrogen. This investment is likely to enhance the accessibility and reliability of hydrogen supply chains, thereby encouraging more industries to transition to hydrogen-based solutions. The establishment of such infrastructure is crucial for achieving the projected market growth and realizing the full potential of blue hydrogen.

Technological Advancements in Hydrogen Production

Technological innovations in hydrogen production processes are propelling the Global Blue Hydrogen Market Industry forward. Advances in carbon capture and storage (CCS) technologies enhance the efficiency of blue hydrogen production, making it a more attractive option for industries seeking to reduce their carbon footprint. As these technologies mature, they are expected to lower production costs and improve the overall viability of blue hydrogen. The integration of CCS with natural gas reforming is particularly noteworthy, as it allows for significant reductions in greenhouse gas emissions. This technological evolution is likely to contribute to the market's projected growth, with a compound annual growth rate of 46.21% from 2025 to 2035.