Regulatory Framework and Support

The Petroleum Refining Blue Hydrogen Market is significantly influenced by the regulatory frameworks established by various governments. Policies aimed at reducing greenhouse gas emissions and promoting cleaner energy sources are driving investments in blue hydrogen technologies. For instance, several countries have introduced tax incentives and subsidies for companies investing in hydrogen production facilities. This regulatory support is crucial, as it not only encourages innovation but also facilitates the establishment of a robust infrastructure for hydrogen distribution. As a result, the Petroleum Refining Blue Hydrogen Market is likely to expand, attracting more players and fostering competition.

Investment in Infrastructure Development

Investment in infrastructure development is a critical driver for the Petroleum Refining Blue Hydrogen Market. The establishment of hydrogen production facilities, storage systems, and distribution networks is essential for the effective commercialization of blue hydrogen. Recent reports indicate that investments in hydrogen infrastructure are expected to exceed several billion dollars in the coming years. This influx of capital is likely to enhance the operational capabilities of the Petroleum Refining Blue Hydrogen Market, enabling it to meet the growing demand for hydrogen as a clean energy source. Furthermore, improved infrastructure will facilitate the integration of hydrogen into existing energy systems.

Increasing Demand for Low-Carbon Solutions

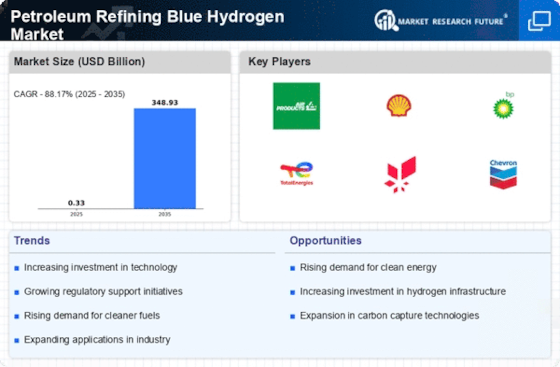

The Petroleum Refining Blue Hydrogen Market is witnessing an increasing demand for low-carbon energy solutions. As industries and consumers become more environmentally conscious, the shift towards sustainable energy sources is accelerating. The market for blue hydrogen is projected to grow, with estimates suggesting a compound annual growth rate (CAGR) of around 15% over the next decade. This growth is driven by the need for cleaner fuels in sectors such as transportation and manufacturing. Consequently, the Petroleum Refining Blue Hydrogen Market is positioned to play a pivotal role in the transition towards a more sustainable energy landscape.

Technological Innovations in Hydrogen Production

The Petroleum Refining Blue Hydrogen Market is experiencing a surge in technological innovations that enhance hydrogen production efficiency. Advanced methods such as steam methane reforming with carbon capture and storage (CCS) are becoming more prevalent. These technologies not only reduce carbon emissions but also improve the overall economic viability of hydrogen production. According to recent data, the efficiency of hydrogen production through these methods has increased by approximately 20% over the past few years. This trend suggests that as technology continues to evolve, the Petroleum Refining Blue Hydrogen Market may witness a significant increase in production capacity, thereby meeting the rising demand for cleaner energy solutions.

Collaboration and Partnerships in the Energy Sector

Collaboration and partnerships within the energy sector are emerging as a vital driver for the Petroleum Refining Blue Hydrogen Market. Companies are increasingly forming alliances to share knowledge, resources, and technologies related to hydrogen production and utilization. These collaborations can lead to innovative solutions that enhance efficiency and reduce costs. For instance, joint ventures between oil and gas companies and technology firms are becoming more common, allowing for the development of cutting-edge hydrogen production methods. This trend indicates that the Petroleum Refining Blue Hydrogen Market is likely to benefit from shared expertise, ultimately accelerating its growth and adoption.