Growing Awareness and Education

Rising awareness and education regarding blood disorders and their treatments significantly influence the Global Blood Cell Factor Market Industry. Public health campaigns and educational programs are essential in informing patients and healthcare providers about available therapies and the importance of early diagnosis. Increased awareness leads to higher rates of diagnosis and treatment, thereby driving market growth. For example, organizations dedicated to blood health are actively promoting screening and treatment options, which could lead to a more informed patient population. This trend is likely to sustain market growth as more individuals seek necessary interventions.

Regulatory Support and Approvals

Regulatory support plays a crucial role in shaping the Global Blood Cell Factor Market Industry. Governments and regulatory bodies are increasingly streamlining the approval processes for new therapies and treatments, facilitating quicker access to innovative blood cell factors. This supportive environment encourages pharmaceutical companies to invest in research and development, leading to a broader range of treatment options for patients. As regulatory frameworks evolve, the market is poised for growth, with new products entering the market and enhancing treatment availability.

Rising Prevalence of Blood Disorders

The increasing incidence of blood disorders globally drives the Global Blood Cell Factor Market Industry. Conditions such as anemia, hemophilia, and various leukemias are becoming more prevalent, necessitating advanced treatment options. For instance, the World Health Organization reports that anemia affects approximately 1.62 billion people worldwide. This growing patient population creates a substantial demand for blood cell factors, which are essential in managing these disorders. As a result, the market is projected to reach 3.21 USD Billion in 2024, reflecting the urgent need for effective therapies and interventions in the healthcare system.

Technological Advancements in Treatment

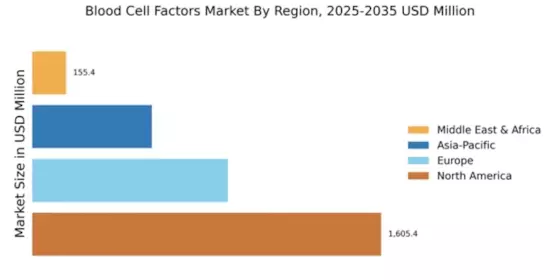

Innovations in biotechnology and pharmaceuticals significantly enhance the Global Blood Cell Factor Market Industry. Advanced therapies, including gene therapy and monoclonal antibodies, are revolutionizing treatment protocols for blood-related conditions. For example, the development of CAR T-cell therapy has shown promising results in treating certain types of leukemia and lymphoma. These technological advancements not only improve patient outcomes but also expand the range of available treatment options. Consequently, the market is expected to grow at a CAGR of 3.57% from 2025 to 2035, indicating a robust future driven by continuous innovation.

Increased Investment in Healthcare Infrastructure

The expansion of healthcare infrastructure globally contributes positively to the Global Blood Cell Factor Market Industry. Governments and private sectors are investing heavily in healthcare facilities, particularly in emerging economies. This investment aims to improve access to advanced medical treatments and technologies, including blood cell factors. For instance, initiatives to enhance laboratory capabilities and blood banks are crucial for effective diagnosis and treatment. As healthcare systems evolve, the market is anticipated to grow, reaching 4.72 USD Billion by 2035, reflecting the increasing accessibility of essential treatments for blood disorders.