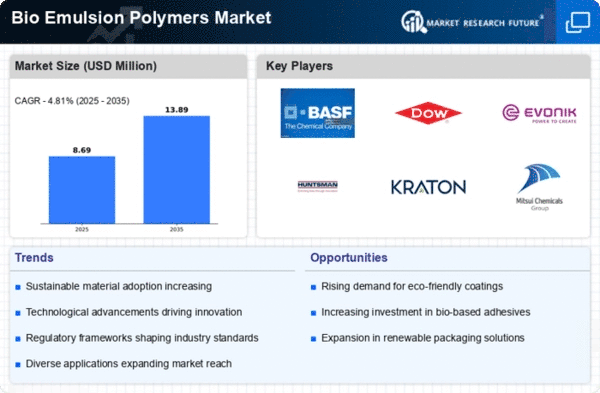

Market Growth Projections

The Global Bio-Emulsion Polymers Market Industry is projected to experience substantial growth over the coming years. With a market size estimated at 2500 USD Million in 2024, the industry is expected to double by 2035, reaching approximately 5000 USD Million. This growth trajectory suggests a robust demand for bio-emulsion polymers across various applications, including coatings, adhesives, and sealants. The anticipated compound annual growth rate of 6.5% from 2025 to 2035 further indicates a strong market potential driven by sustainability trends and regulatory support for eco-friendly materials.

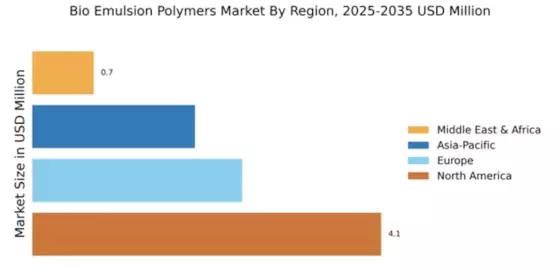

Growing Construction Sector

The expansion of the global construction sector serves as a key driver for the Global Bio-Emulsion Polymers Market Industry. As urbanization accelerates worldwide, there is a rising demand for construction materials that are both effective and environmentally friendly. Bio-emulsion polymers are increasingly utilized in paints, coatings, and sealants, which are essential in construction projects. This trend is particularly evident in regions experiencing rapid urban development, where sustainable building practices are prioritized. Consequently, the market is anticipated to grow, with a projected market size of 2500 USD Million in 2024, reflecting the increasing integration of bio-emulsion polymers in construction.

Sustainable Material Demand

The increasing global emphasis on sustainability drives the Global Bio-Emulsion Polymers Market Industry. As industries seek eco-friendly alternatives to traditional petroleum-based products, bio-emulsion polymers emerge as a viable solution. These polymers, derived from renewable resources, align with the growing consumer preference for sustainable materials. For instance, the construction and automotive sectors are increasingly adopting bio-emulsion polymers for their lower environmental impact. This shift is expected to contribute to the market's growth, with projections indicating a market size of 2500 USD Million in 2024, potentially reaching 5000 USD Million by 2035.

Regulatory Support for Green Products

Government regulations promoting the use of environmentally friendly products bolster the Global Bio-Emulsion Polymers Market Industry. Various countries are implementing stringent regulations aimed at reducing carbon footprints and promoting sustainable practices. For example, the European Union has introduced policies encouraging the use of bio-based materials in manufacturing. Such regulatory frameworks create a favorable environment for bio-emulsion polymers, as manufacturers are incentivized to adopt these materials. This trend is likely to enhance market growth, with a projected compound annual growth rate of 6.5% from 2025 to 2035, reflecting the increasing adoption of bio-emulsion polymers.

Technological Advancements in Polymer Production

Innovations in polymer production technologies significantly impact the Global Bio-Emulsion Polymers Market Industry. Advances in processing techniques, such as improved emulsification methods and the development of new catalysts, enhance the efficiency and performance of bio-emulsion polymers. These technological improvements not only reduce production costs but also expand the range of applications for these polymers. For instance, enhanced properties allow for their use in coatings, adhesives, and sealants, which are critical in various industries. As a result, the market is poised for growth, with expectations of reaching 5000 USD Million by 2035.

Consumer Awareness and Preference for Eco-Friendly Products

The rising consumer awareness regarding environmental issues significantly influences the Global Bio-Emulsion Polymers Market Industry. As consumers become more informed about the impact of their purchasing decisions, there is a notable shift towards eco-friendly products. This trend is particularly pronounced in sectors such as personal care, where bio-emulsion polymers are used in formulations that appeal to environmentally conscious consumers. Companies are responding by incorporating bio-emulsion polymers into their products, thereby enhancing their market appeal. This growing preference is expected to drive market growth, contributing to a compound annual growth rate of 6.5% from 2025 to 2035.