Regulatory Influence

Regulatory frameworks play a crucial role in shaping the Synthetic and Bio Emulsion Polymer Market. Governments worldwide are implementing stringent regulations aimed at reducing environmental impact and promoting the use of sustainable materials. For instance, regulations concerning volatile organic compounds (VOCs) are driving manufacturers to develop low-emission emulsion polymers. In 2025, it is anticipated that compliance with these regulations will lead to a market shift, with an estimated 30% of emulsion polymers being produced with reduced VOC content. This regulatory influence not only compels innovation but also creates opportunities for companies that can adapt quickly to changing standards. As a result, the Synthetic and Bio Emulsion Polymer Market is likely to witness a transformation in product offerings, with a greater emphasis on compliance and sustainability.

Sustainability Focus

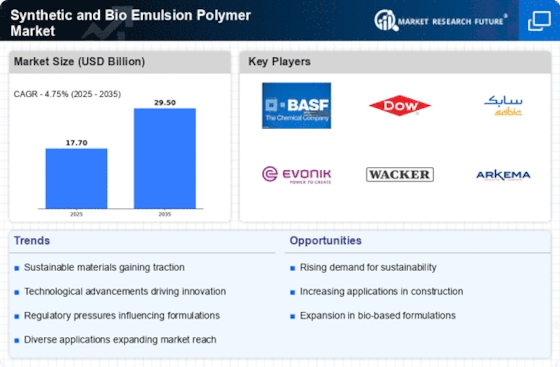

The increasing emphasis on sustainability is a pivotal driver for the Synthetic and Bio Emulsion Polymer Market. As consumers and industries alike prioritize eco-friendly products, manufacturers are compelled to innovate and develop sustainable emulsion polymers. This shift is evidenced by a growing demand for bio-based polymers, which are derived from renewable resources. In 2025, the market for bio-based emulsion polymers is projected to reach approximately USD 1.5 billion, reflecting a compound annual growth rate of around 8%. This trend not only aligns with environmental goals but also enhances brand reputation, as companies that adopt sustainable practices are often viewed more favorably by consumers. Consequently, the focus on sustainability is likely to shape product development and market strategies within the Synthetic and Bio Emulsion Polymer Market.

Technological Advancements

Technological advancements are significantly propelling the Synthetic and Bio Emulsion Polymer Market forward. Innovations in polymerization techniques and formulation technologies are enabling the development of high-performance emulsion polymers that meet diverse application needs. For example, advancements in nanotechnology are enhancing the properties of emulsion polymers, making them more effective in applications such as coatings and adhesives. In 2025, the market is expected to see a surge in demand for technologically advanced emulsion polymers, with a projected growth rate of 7% annually. This growth is indicative of the industry's response to the need for improved performance and functionality in various sectors, including construction, automotive, and consumer goods. Thus, technological progress is likely to remain a key driver in shaping the future landscape of the Synthetic and Bio Emulsion Polymer Market.

Rising Demand in Construction

The construction sector is experiencing a robust demand for synthetic and bio emulsion polymers, serving as a significant driver for the Synthetic and Bio Emulsion Polymer Market. With the ongoing urbanization and infrastructure development, the need for high-quality adhesives, sealants, and coatings is escalating. In 2025, the construction industry is projected to account for over 40% of the total demand for emulsion polymers, reflecting a growing trend towards durable and sustainable building materials. This demand is further fueled by the increasing adoption of green building practices, which prioritize the use of eco-friendly materials. Consequently, the Synthetic and Bio Emulsion Polymer Market is likely to benefit from this rising demand, as manufacturers align their product offerings with the needs of the construction sector.

Expanding Applications in Consumer Goods

The expanding applications of synthetic and bio emulsion polymers in consumer goods represent a vital driver for the Synthetic and Bio Emulsion Polymer Market. As consumer preferences shift towards high-performance and sustainable products, manufacturers are increasingly incorporating emulsion polymers into various consumer goods, including paints, textiles, and personal care products. In 2025, it is estimated that the consumer goods sector will contribute approximately 25% to the overall market share of emulsion polymers. This growth is indicative of the versatility and adaptability of emulsion polymers, which can enhance product performance while meeting consumer demands for sustainability. As a result, the Synthetic and Bio Emulsion Polymer Market is poised for growth, driven by the expanding applications and the need for innovative solutions in consumer goods.