Emulsion Polymers Market Summary

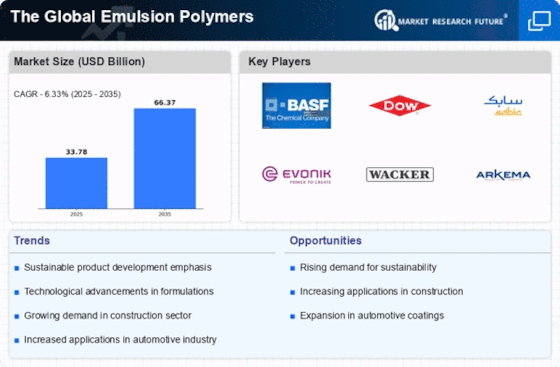

As per Market Research Future analysis, The Global Emulsion Polymers Market Size was estimated at 33.78 USD Billion in 2024. The emulsion polymers industry is projected to grow from 35.92 USD Billion in 2025 to 66.37 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.33% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Emulsion Polymers Market is poised for robust growth driven by sustainability and technological advancements.

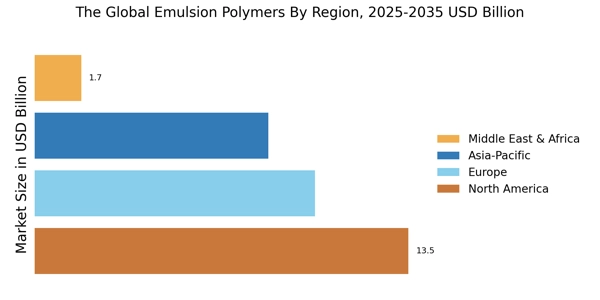

- North America remains the largest market for emulsion polymers, reflecting a strong demand across various applications.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid industrialization and urbanization.

- Vinyl acetate polymers dominate the market, while acrylics are gaining traction as the fastest-growing segment due to their versatility.

- Key market drivers include sustainability initiatives and the growing construction sector, which are significantly influencing demand for adhesives and sealants.

Market Size & Forecast

| 2024 Market Size | 33.78 (USD Billion) |

| 2035 Market Size | 66.37 (USD Billion) |

| CAGR (2025 - 2035) | 6.33% |

Major Players

BASF SE (DE), Dow Inc. (US), SABIC (SA), Evonik Industries AG (DE), Wacker Chemie AG (DE), Arkema S.A. (FR), Huntsman Corporation (US), Celanese Corporation (US), Mitsubishi Chemical Corporation (JP)