Technological Innovations

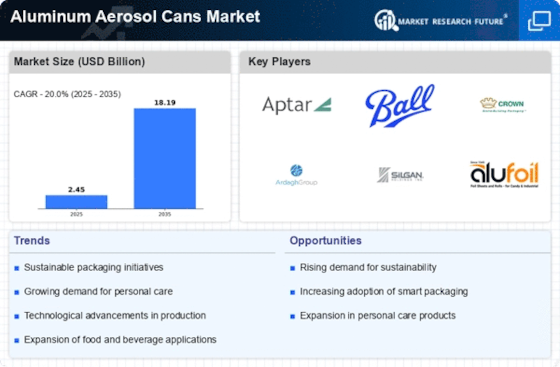

Technological advancements play a pivotal role in shaping the Aluminum Aerosol Cans Market. Innovations in manufacturing processes, such as the development of lightweight aluminum alloys, have enhanced the efficiency and performance of aerosol cans. These advancements not only reduce material costs but also improve the overall user experience. For instance, the introduction of advanced filling technologies allows for better product preservation and longer shelf life. Additionally, the integration of smart technologies, such as QR codes and augmented reality, is becoming more prevalent, enabling brands to engage consumers in novel ways. The market is projected to grow at a compound annual growth rate (CAGR) of around 4% over the next few years, driven by these technological innovations that enhance product functionality and consumer interaction within the Aluminum Aerosol Cans Market.

Sustainability Initiatives

The Aluminum Aerosol Cans Market is increasingly influenced by sustainability initiatives. As consumers become more environmentally conscious, manufacturers are compelled to adopt eco-friendly practices. Aluminum is highly recyclable, and its use in aerosol cans aligns with the growing demand for sustainable packaging solutions. In fact, the recycling rate for aluminum cans is approximately 75%, which is significantly higher than that of other materials. This high recyclability not only reduces waste but also conserves energy, making aluminum aerosol cans a preferred choice for brands aiming to enhance their sustainability profiles. Furthermore, regulatory pressures are mounting globally, pushing companies to minimize their carbon footprints. As a result, the Aluminum Aerosol Cans Market is likely to witness a surge in demand as brands seek to meet consumer expectations and comply with environmental regulations.

Diverse End-User Industries

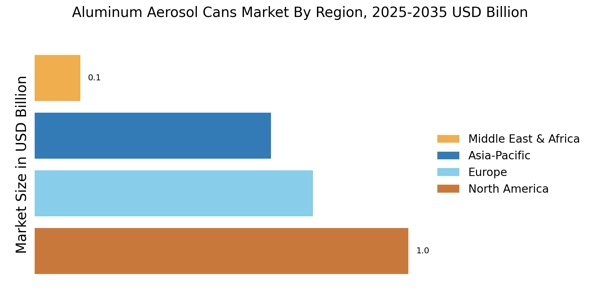

The Aluminum Aerosol Cans Market benefits from its diverse applications across various end-user sectors. Industries such as personal care, household products, and food and beverages are increasingly adopting aluminum aerosol cans for their packaging needs. For example, the personal care sector, which includes products like deodorants and hair sprays, is a significant contributor to market growth. In 2023, the personal care segment accounted for nearly 40% of the total market share, reflecting the versatility of aluminum cans in meeting the specific requirements of different products. Moreover, the food and beverage industry is also recognizing the advantages of aluminum foil packaging, such as extended shelf life and enhanced product safety. This diversification across sectors is likely to sustain the growth momentum of the Aluminum Aerosol Cans Market, as it adapts to the evolving needs of various consumer segments.

Consumer Preferences for Convenience

Consumer preferences are shifting towards convenience, significantly impacting the Aluminum Aerosol Cans Market. As lifestyles become busier, the demand for easy-to-use packaging solutions is on the rise. Aluminum aerosol cans offer a user-friendly experience, allowing for quick and efficient application of products. This convenience is particularly evident in the personal care and household cleaning sectors, where consumers favor products that can be used on-the-go. Additionally, the lightweight nature of aluminum cans enhances portability, making them an attractive option for consumers. Market Research Future indicates that products packaged in aluminum aerosol cans are perceived as more modern and innovative, further driving their popularity. As consumer preferences continue to evolve, the Aluminum Aerosol Cans Market is likely to adapt, focusing on convenience-driven innovations to meet the demands of a fast-paced lifestyle.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical drivers in the Aluminum Aerosol Cans Market. Governments and regulatory bodies are increasingly implementing stringent safety regulations to ensure consumer protection and environmental sustainability. These regulations often pertain to the materials used in packaging, labeling requirements, and the disposal of aerosol products. Compliance with these standards is essential for manufacturers to maintain market access and consumer trust. In recent years, there has been a notable increase in regulations concerning the use of propellants and the recyclability of packaging materials. This trend is likely to continue, compelling companies within the Aluminum Aerosol Cans Market to invest in research and development to meet these evolving standards. As a result, adherence to regulatory requirements not only enhances product safety but also fosters innovation, driving growth within the industry.