Growing E-commerce Sector

The rapid expansion of the e-commerce sector in Southeast Asia is significantly influencing the ERP Software Market. With the increasing number of online businesses, there is a heightened need for integrated software solutions that can manage inventory, sales, and customer relationships effectively. Recent statistics indicate that e-commerce sales in the region are projected to reach USD 100 billion by 2025, highlighting the immense potential for growth. As e-commerce companies seek to optimize their operations and enhance customer experiences, the demand for ERP systems that can provide real-time data and streamline processes is likely to increase. This trend suggests that the growth of the e-commerce sector will be a crucial driver for the Southeast Asia ERP Software Market, as businesses invest in technology to support their expansion.

Rising Demand for Automation

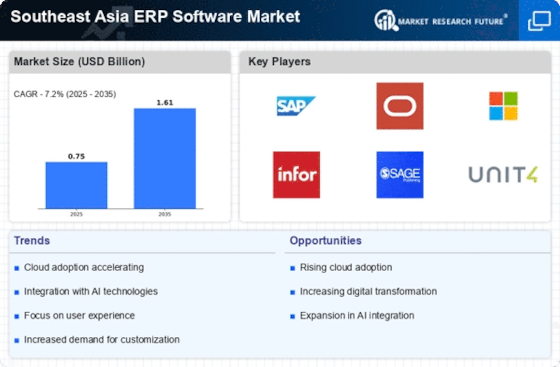

The Southeast Asia ERP Software Market is experiencing a notable surge in demand for automation solutions. Businesses across various sectors are increasingly recognizing the need to streamline operations and enhance efficiency. According to recent data, the automation market in Southeast Asia is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend is driven by the desire to reduce operational costs and improve productivity. As organizations seek to integrate automated processes into their workflows, ERP software becomes a critical component, enabling seamless data flow and real-time insights. Consequently, the rising demand for automation is likely to propel the growth of the Southeast Asia ERP Software Market, as companies invest in advanced technologies to remain competitive.

Increased Focus on Data Analytics

In the Southeast Asia ERP Software Market, there is a growing emphasis on data analytics capabilities. Organizations are increasingly leveraging data to make informed decisions and drive strategic initiatives. The market for business intelligence and analytics tools is expected to expand significantly, with estimates suggesting a growth rate of around 15% annually. This trend indicates that companies are prioritizing data-driven insights to enhance operational efficiency and customer engagement. ERP systems equipped with robust analytics features allow businesses to analyze trends, forecast demand, and optimize resource allocation. As a result, the integration of advanced analytics within ERP solutions is likely to be a key driver of growth in the Southeast Asia ERP Software Market, as firms seek to harness the power of data.

Rising Awareness of Compliance and Risk Management

In the Southeast Asia ERP Software Market, there is an increasing awareness among businesses regarding compliance and risk management. As regulatory frameworks become more stringent, organizations are recognizing the importance of adhering to legal and industry standards. This awareness is driving the demand for ERP solutions that offer comprehensive compliance features and risk management tools. Companies are seeking to mitigate potential risks associated with data breaches and regulatory non-compliance, which can lead to significant financial penalties. The market for compliance-focused ERP software is expected to grow, as businesses prioritize solutions that can help them navigate complex regulatory landscapes. Consequently, the rising awareness of compliance and risk management is likely to serve as a key driver for the Southeast Asia ERP Software Market, as firms invest in systems that enhance their governance and operational resilience.

Government Initiatives Supporting Digital Transformation

Government initiatives aimed at promoting digital transformation are playing a pivotal role in the Southeast Asia ERP Software Market. Various Southeast Asian governments are implementing policies and programs to encourage the adoption of digital technologies among businesses. For instance, initiatives such as tax incentives and grants for technology investments are becoming increasingly common. These efforts are designed to enhance the competitiveness of local enterprises and stimulate economic growth. As a result, the demand for ERP software solutions is expected to rise, as businesses seek to comply with regulatory requirements and leverage technology for operational improvements. The supportive regulatory environment is likely to foster innovation and investment in the Southeast Asia ERP Software Market, driving further growth.