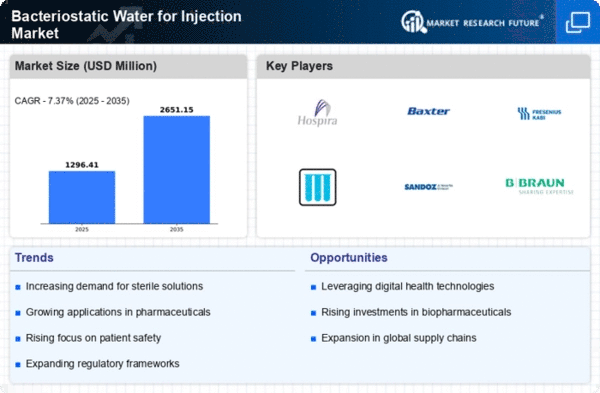

Market Growth Projections

The Global Bacteriostatic Water for Injection Market Industry is projected to experience substantial growth over the next decade. With a market value of 1.2 USD Billion in 2024, it is anticipated to reach 2.51 USD Billion by 2035, reflecting a CAGR of 6.92% from 2025 to 2035. This growth trajectory is driven by various factors, including the rising demand for injectable medications, advancements in manufacturing technologies, and increased regulatory support. The market's expansion indicates a robust future for bacteriostatic water, highlighting its critical role in the pharmaceutical industry.

Increase in Biologics and Biosimilars

The rise of biologics and biosimilars is a key driver for the Global Bacteriostatic Water for Injection Market Industry. As these complex therapies often require reconstitution with bacteriostatic water, the demand for such solutions is expected to increase. The global shift towards personalized medicine and the growing number of biologics entering the market necessitate reliable and safe diluents. This trend is likely to contribute to the market's growth, as manufacturers adapt to meet the specific needs of biologics, thereby enhancing the overall landscape of injectable therapies.

Rising Demand for Injectable Medications

The Global Bacteriostatic Water for Injection Market Industry experiences a notable surge in demand for injectable medications, driven by the increasing prevalence of chronic diseases and the growing geriatric population. As healthcare providers increasingly prefer injectable formulations for their rapid onset of action, the market is poised for growth. In 2024, the market is valued at approximately 1.2 USD Billion, reflecting the rising reliance on injectable therapies. This trend is expected to continue, as the World Health Organization emphasizes the importance of effective medication delivery systems in improving patient outcomes.

Regulatory Support for Injectable Solutions

Regulatory bodies worldwide are increasingly supporting the development and approval of injectable solutions, which positively impacts the Global Bacteriostatic Water for Injection Market Industry. Initiatives aimed at streamlining the approval process for new injectable drugs encourage pharmaceutical companies to invest in research and development. This regulatory environment fosters innovation and enhances the availability of injectable medications. As a result, the market is expected to expand significantly, with projections indicating a market value of 2.51 USD Billion by 2035, reflecting the growing acceptance of injectable therapies in clinical practice.

Advancements in Pharmaceutical Manufacturing

Technological advancements in pharmaceutical manufacturing processes significantly influence the Global Bacteriostatic Water for Injection Market Industry. Innovations such as automated filling systems and enhanced sterilization techniques improve the efficiency and safety of injectable drug production. These advancements not only reduce production costs but also ensure compliance with stringent regulatory standards. As a result, manufacturers are better positioned to meet the growing demand for high-quality bacteriostatic water. The market is projected to grow at a CAGR of 6.92% from 2025 to 2035, indicating a robust future driven by these manufacturing improvements.

Global Health Initiatives and Vaccination Programs

Global health initiatives and vaccination programs significantly impact the Global Bacteriostatic Water for Injection Market Industry. As governments and organizations prioritize vaccination to combat infectious diseases, the demand for bacteriostatic water as a diluent for vaccines is likely to rise. These initiatives not only enhance public health but also stimulate market growth by increasing the volume of injectable solutions required. The ongoing commitment to improving global health outcomes suggests a sustained demand for bacteriostatic water, further solidifying its role in the pharmaceutical landscape.