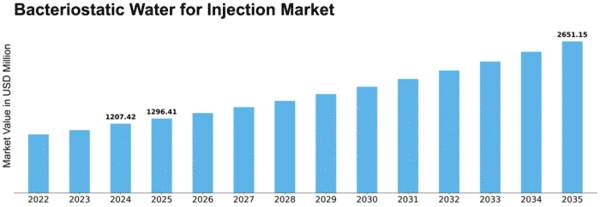

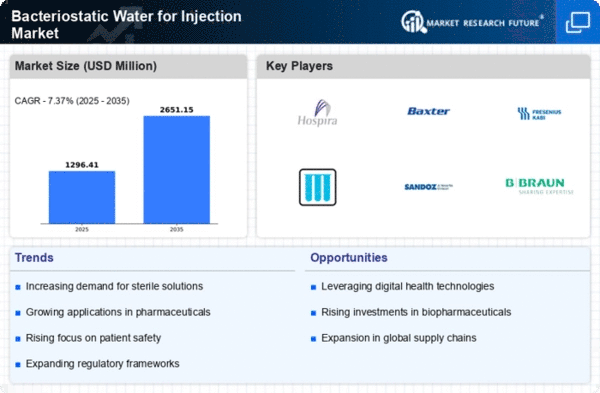

Bacteriostatic Water For Injection Size

Bacteriostatic Water for Injection Market Growth Projections and Opportunities

The Bacteriostatic Water for Injection (BWFI) Market has emerged as a vital segment in the healthcare and pharmaceutical industry, gaining traction due to its widespread use in various medical applications. Bacteriostatic water is sterile water that contains a bacteriostatic agent, typically benzyl alcohol, which inhibits the growth of bacteria within the solution. This specialized type of water finds extensive applications, particularly in reconstituting medications and diluting drugs for injection purposes.

One of the primary drivers behind the growth of the Bacteriostatic Water for Injection Market is its indispensable role in pharmaceutical formulations. Many medications, especially those in powdered or lyophilized form, require reconstitution before administration. Bacteriostatic water serves as an essential medium for this reconstitution process, ensuring that the medication is appropriately dissolved and ready for injection. This critical function has propelled the demand for bacteriostatic water in pharmaceutical manufacturing and compounding pharmacies.

The market also experiences a surge in demand from the healthcare sector, where Bacteriostatic Water for Injection is commonly used in clinical settings. Hospitals, clinics, and healthcare facilities utilize bacteriostatic water for diluting medications and vaccines, ensuring accurate dosage administration. The inclusion of a bacteriostatic agent in the water helps prevent the proliferation of bacteria within the solution, safeguarding patient safety during injections. This aspect makes bacteriostatic water a preferred choice in various medical applications, contributing to its market growth.

Furthermore, the Bacteriostatic Water for Injection Market plays a crucial role in supporting the growing trend of home-based healthcare. As more patients receive medical treatments in the comfort of their homes, the need for safe and reliable solutions for medication reconstitution becomes paramount. Bacteriostatic water, with its ability to inhibit bacterial growth and maintain sterility, addresses this need effectively, enabling patients to self-administer certain medications with confidence.

The market's expansion is also driven by the rising prevalence of chronic diseases that require long-term or frequent medication administration. Conditions such as diabetes, where patients regularly inject insulin, highlight the importance of having a reliable and sterile medium for drug preparation. Bacteriostatic Water for Injection proves instrumental in meeting these requirements, supporting the management of chronic illnesses and enhancing the overall quality of patient care.

However, challenges such as stringent regulatory requirements and the need for adherence to quality standards pose considerations for manufacturers and suppliers in the Bacteriostatic Water for Injection Market. Striking a balance between meeting regulatory guidelines and ensuring product accessibility remains a key factor for success in this market.

Leave a Comment