Expansion of E-commerce

The expansion of e-commerce significantly impacts the Global Autonomous Mobile Manipulator Robots (AMMR) Market Industry. With the surge in online shopping, logistics and warehousing operations are under pressure to enhance efficiency and speed. AMMRs are increasingly deployed in fulfillment centers to automate the movement of goods, thereby streamlining operations. This trend is expected to drive market growth, as companies seek to optimize their supply chains. The integration of AMMRs in e-commerce logistics not only improves operational efficiency but also enhances customer satisfaction through faster delivery times, making them indispensable in the evolving retail landscape.

Growing Labor Shortages

The Global Autonomous Mobile Manipulator Robots (AMMR) Market Industry is significantly influenced by the growing labor shortages in various sectors. As industries face challenges in recruiting skilled labor, the reliance on AMMRs as a solution becomes increasingly apparent. For instance, in logistics, AMMRs can handle repetitive tasks, alleviating the burden on human workers. This trend is particularly pronounced in regions experiencing demographic shifts, where the workforce is aging. The adoption of AMMRs not only addresses labor shortages but also enhances productivity, making them a vital component in the operational strategies of businesses aiming to maintain competitiveness.

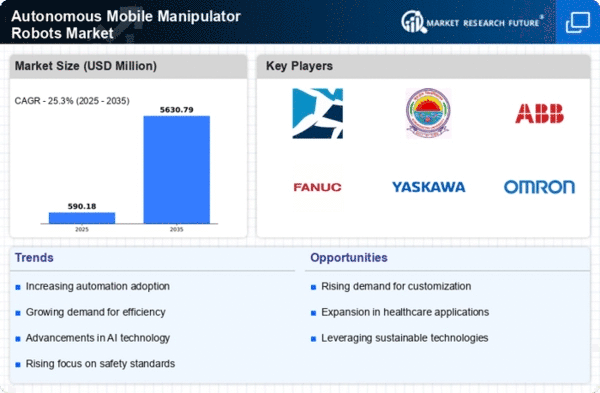

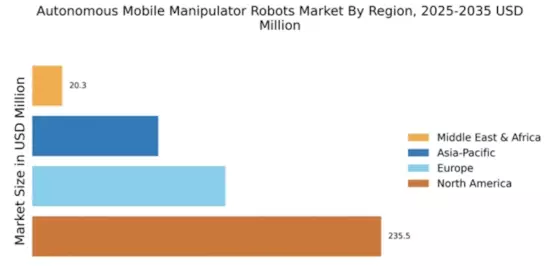

Market Growth Projections

The Global Autonomous Mobile Manipulator Robots (AMMR) Market Industry is projected to experience substantial growth over the coming years. With an estimated market value of 0.43 USD Billion in 2024, it is anticipated to reach 5.63 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 26.33% from 2025 to 2035, indicating a robust expansion driven by technological advancements and increasing adoption across various sectors. The market's evolution is likely to be characterized by innovations in robotics, enhanced functionalities, and a broader range of applications, positioning AMMRs as crucial components in the future of automation.

Technological Advancements

Technological advancements play a pivotal role in the expansion of the Global Autonomous Mobile Manipulator Robots (AMMR) Market Industry. Innovations in artificial intelligence, machine learning, and sensor technologies enhance the capabilities of AMMRs, allowing for improved navigation, object recognition, and task execution. For example, the integration of advanced vision systems enables AMMRs to operate in dynamic environments, increasing their applicability in sectors such as retail and healthcare. These advancements not only improve operational efficiency but also broaden the scope of tasks that AMMRs can perform, thereby driving market growth and attracting investment in research and development.

Rising Investment in Robotics

Rising investment in robotics is a key driver of the Global Autonomous Mobile Manipulator Robots (AMMR) Market Industry. Governments and private sectors are increasingly allocating funds to develop and deploy robotic solutions, recognizing their potential to transform industries. For example, initiatives aimed at fostering innovation in robotics have been launched in various countries, promoting research and development. This influx of capital supports the advancement of AMMR technologies, facilitating their integration into diverse applications. As investment continues to grow, the market is likely to witness accelerated development, positioning AMMRs as essential tools in modern industrial operations.

Increased Demand for Automation

The Global Autonomous Mobile Manipulator Robots (AMMR) Market Industry experiences heightened demand for automation across various sectors, including manufacturing, logistics, and healthcare. As industries strive for efficiency and cost reduction, the adoption of AMMRs has surged. For instance, in manufacturing, AMMRs streamline assembly lines and reduce labor costs. This trend is projected to contribute to the market's growth, with an estimated value of 0.43 USD Billion in 2024, potentially escalating to 5.63 USD Billion by 2035. The compound annual growth rate (CAGR) of 26.33% from 2025 to 2035 underscores the industry's shift towards automation and the integration of advanced robotics.