Growing Focus on Safety and Ergonomics

Safety and ergonomics are increasingly becoming focal points in various industries, influencing the autonomous mobile-manipulator-robots-ammr market. Companies are recognizing the importance of reducing workplace injuries and enhancing employee well-being. AMMRs can undertake hazardous tasks, thereby minimizing human exposure to dangerous environments. In 2025, it is estimated that workplace injuries could cost US businesses over $60 billion annually. By deploying AMMRs, organizations can potentially reduce these costs while improving overall safety standards. This growing emphasis on safety and ergonomics is likely to drive the adoption of autonomous mobile-manipulator-robots-ammr market solutions across sectors such as construction, manufacturing, and logistics.

Rising Demand for Automation in Manufacturing

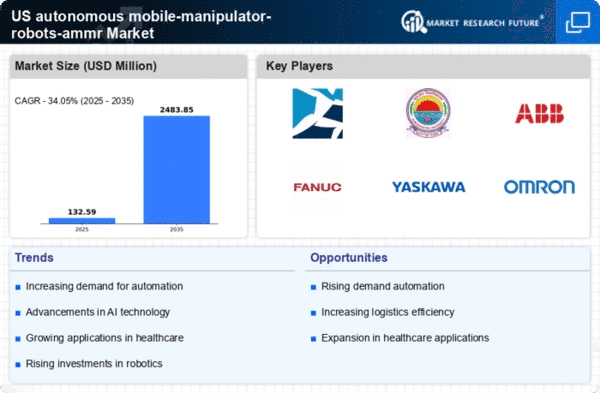

The The autonomous mobile-manipulator-robots-ammr market is experiencing a surge in demand. This demand is driven by the increasing need for automation in manufacturing processes. As industries strive for enhanced efficiency and reduced operational costs, the integration of AMMRs is becoming more prevalent. In 2025, the manufacturing sector is projected to allocate approximately $5 billion towards automation technologies. AMMRs will play a pivotal role in this trend, which is likely to continue as manufacturers seek to optimize production lines and minimize human error. The ability of AMMRs to perform repetitive tasks with precision and speed positions them as essential tools in modern manufacturing environments, thereby propelling the growth of the autonomous mobile-manipulator-robots-ammr market.

Technological Advancements in Robotics and AI

Technological advancements in robotics and artificial intelligence (AI) are driving innovation within the autonomous mobile-manipulator-robots-ammr market. The integration of AI algorithms enables AMMRs to learn from their environments, improving their operational efficiency and adaptability. In 2025, the AI in robotics market is projected to exceed $15 billion in the US, highlighting the increasing reliance on intelligent systems. These advancements are likely to enhance the functionality of AMMRs, making them more versatile and capable of performing complex tasks. As industries recognize the benefits of incorporating advanced robotics and AI, the demand for autonomous mobile-manipulator-robots-ammr market solutions is expected to rise.

Increased Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the autonomous mobile-manipulator-robots-ammr market. As technology evolves, companies are allocating substantial resources to innovate and enhance AMMR capabilities. In 2025, R&D spending in robotics is projected to reach $10 billion in the US. This reflects a commitment to advancing automation technologies. This investment is likely to lead to breakthroughs in areas such as navigation, manipulation, and AI integration, further expanding the potential applications of AMMRs. The continuous improvement of these technologies is expected to attract more industries to adopt autonomous mobile-manipulator-robots-ammr market solutions, thereby fostering market growth.

Expansion of E-commerce and Last-Mile Delivery Solutions

The rapid expansion of e-commerce is significantly impacting the autonomous mobile-manipulator-robots-ammr market, particularly in last-mile delivery solutions. As online shopping continues to grow, companies are seeking efficient ways to fulfill orders and meet customer expectations. AMMRs are increasingly being utilized for last-mile delivery, offering a cost-effective and timely solution. In 2025, the last-mile delivery market is anticipated to reach $30 billion in the US, with AMMRs playing a crucial role in this transformation. This trend indicates a strong potential for growth in the autonomous mobile-manipulator-robots-ammr market as businesses look to enhance their logistics capabilities.