Increased Adoption of Diesel Engines

The Automotive Turbocharger Market is witnessing a notable increase in the adoption of diesel engines, particularly in commercial vehicles and light-duty trucks. Diesel engines, known for their torque and fuel efficiency, often utilize turbocharging to enhance performance. The demand for diesel-powered vehicles is projected to rise, with an expected growth rate of 8% in the next five years. This trend is driven by the need for efficient transportation solutions in logistics and freight sectors. Consequently, the Automotive Turbocharger Market is likely to benefit from this shift, as manufacturers focus on developing turbochargers specifically designed for diesel applications.

Rising Fuel Prices and Economic Factors

The Automotive Turbocharger Market is also shaped by rising fuel prices, which have led consumers to seek more fuel-efficient vehicles. Turbochargers play a crucial role in enhancing engine efficiency, allowing for better fuel economy without sacrificing performance. As fuel prices continue to fluctuate, the demand for turbocharged vehicles is likely to increase, with projections indicating a potential growth rate of 12% in the next few years. Economic factors, including disposable income and consumer preferences for cost-effective solutions, further contribute to the expansion of the Automotive Turbocharger Market, as buyers prioritize efficiency in their vehicle choices.

Regulatory Pressure for Emission Reductions

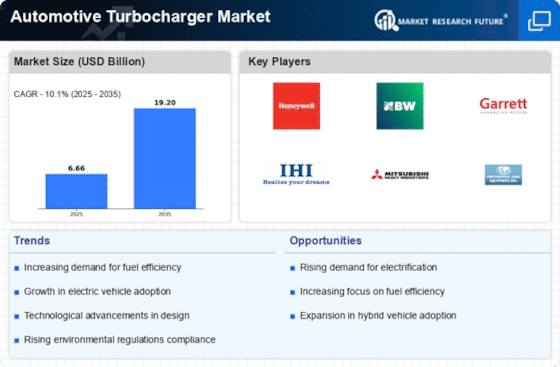

The Automotive Turbocharger Market is significantly influenced by stringent emission regulations imposed by governments worldwide. These regulations aim to reduce greenhouse gas emissions and improve fuel economy, compelling manufacturers to adopt turbocharging technologies. Turbochargers enable smaller engines to produce more power while maintaining lower emissions, aligning with regulatory requirements. As a result, the market for turbochargers is expected to grow, with an estimated increase of 10% in demand for turbocharged vehicles by 2026. This regulatory landscape not only drives innovation but also positions the Automotive Turbocharger Market as a key player in the transition towards more sustainable automotive solutions.

Technological Innovations in Turbocharger Design

The Automotive Turbocharger Market is experiencing a surge in technological innovations that enhance performance and efficiency. Advanced materials, such as lightweight alloys and composites, are being utilized to improve durability and reduce weight. Furthermore, the integration of variable geometry turbochargers allows for better control of boost pressure, optimizing engine performance across various RPM ranges. According to recent data, the adoption of these advanced turbocharger designs is projected to increase by approximately 15% over the next five years. This trend indicates a strong consumer preference for vehicles that offer both power and fuel efficiency, driving growth in the Automotive Turbocharger Market.

Consumer Preference for High-Performance Vehicles

The Automotive Turbocharger Market is significantly influenced by the growing consumer preference for high-performance vehicles. Enthusiasts and everyday drivers alike are increasingly drawn to turbocharged engines that offer enhanced power and responsiveness. This trend is reflected in the automotive market, where turbocharged models are gaining popularity across various segments, including sports cars and SUVs. Market analysis suggests that the share of turbocharged vehicles could reach 40% by 2027, indicating a robust demand for performance-oriented solutions. As manufacturers respond to this consumer trend, the Automotive Turbocharger Market is poised for substantial growth, driven by innovations that cater to performance and efficiency.