Market Trends

Key Emerging Trends in the Automotive Turbocharger Market

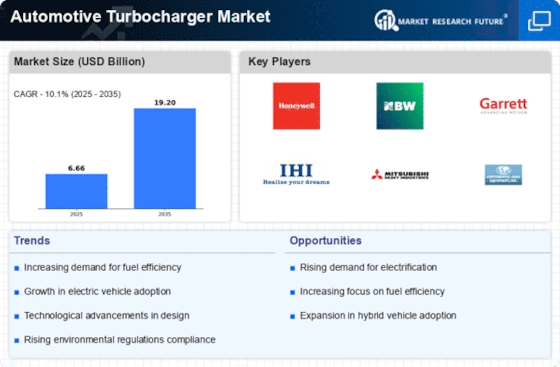

The automotive turbocharger market has experienced significant evolution and adaptation in recent years, largely influenced by several key market trends. One of the primary drivers in this industry is the global push for more fuel-efficient vehicles. Automakers are attracted more and more to turbochargers as a way of satisfying increasingly strict emission regulations and the broader trend towards reducing carbon footprints by optimizing internal combustion engines. Turbocharging technology which enables engines to boost production of power without enhancing the displacement helps in improving fuel economy and reducing emissions, thereby supporting that industry’s efforts towards sustainability.

Additionally, there is a trend for downsized engines that causes an increased demand for turbochargers. The trend towards smaller, turbocharged engines that deliver roughly the same power as larger ones but consume less fuel is becoming more common among automakers. Such a downsizing tendency combined with the use of turbochargers enables achieving better performance without sacrificing efficiency – manufacturers and consumers looking forward to more green-friendly and economic vehicles are equally satisfied.

Also, the increase in hybridization and electrification for vehicles has had an effect on turbocharger technology. Hybrid cars with internal combustion engines often include turbos to increase power output and efficiency. Hybrid systems are integrated with turbocharging, an additional thrust when required that enhances overall performance and economy.

Another important trend that influences the automotive turbocharger market is an increased use of electric vehicles or EVs. Though EVs do not use traditional turbochargers, because of the electric propulsion system used in these cars; automakers have started thinking about adding this technology to hybrid and plug-in HEV. The combination of turbocharging with internal combustion engines in these vehicles helps utilize the latter to their fullest, providing an intermediary solution until automakers complete transition into electrification.

Additionally, technological innovations in turbocharger design and materials are propelling change throughout the market. Manufacturers are always in the development of more efficient and durable turbochargers using advanced materials and engineering techniques. This is through the use of lightweight materials, better aerodynamics and accurate manufacturing that enhances performance with less turbo lag while increasing reliability.

The automotive turbocharger market’s aftermarket segment is also showing significant growth. Due to the desire among consumers for ways through which their vehicles can be upgraded and improved, aftermarket turbocharger kits have become popular. Enthusiasts and performance-minded drivers look for aftermarket turbochargers that raise engine power and torque, which drives market expansion from original equipment makers.

Moreover, the internationalization of automotive products market and increasing supply for cars by developing markets have a significant role in turbocharger market. Increased demand for turbocharger arises from increased automotive production in regions like Asia-Pacific particularly in countries such as China and India.

However, challenges persist within the automotive turbocharger market, including cost constraints, reliability concerns, and the need for further technological advancements to meet stringent emission standards. Manufacturers are continually working to address these challenges by investing in research and development to create more cost-effective, durable, and efficient turbocharging solutions.

Leave a Comment