Automotive Touch Screen Control Systems Market Summary

As per Market Research Future analysis, the Automotive Touch Screen Control Systems Market was estimated at 11.21 USD Billion in 2024. The automotive touch screen control systems industry is projected to grow from 11.98 USD Billion in 2025 to 23.13 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Automotive Touch Screen Control Systems Market is poised for substantial growth driven by technological advancements and evolving consumer preferences.

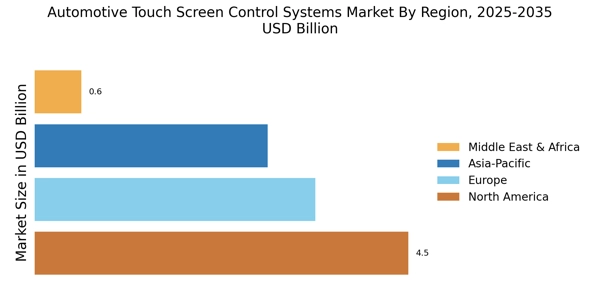

- The integration of advanced technologies is reshaping the automotive touch screen control systems landscape, particularly in North America.

- User experience remains a focal point, with manufacturers prioritizing intuitive interfaces in passenger cars, the largest segment.

- Sustainability initiatives are gaining traction, especially in the Asia-Pacific region, which is recognized as the fastest-growing market.

- Rising consumer demand for connectivity and enhanced user interfaces is a major driver, alongside the regulatory push for improved safety features.

Market Size & Forecast

| 2024 Market Size | 11.21 (USD Billion) |

| 2035 Market Size | 23.13 (USD Billion) |

| CAGR (2025 - 2035) | 6.8% |

Major Players

Continental AG (DE), Denso Corporation (JP), Robert Bosch GmbH (DE), Harman International (US), Panasonic Corporation (JP), LG Electronics (KR), Magna International Inc. (CA), Valeo SA (FR), Aisin Seiki Co., Ltd. (JP)