Shift Towards Electric Vehicles

The automotive touch-screen-control-systems market is significantly influenced by the shift towards electric vehicles (EVs). As the automotive industry transitions to more sustainable options, the integration of advanced touch-screen systems becomes essential for managing various vehicle functions. EVs often require sophisticated interfaces to monitor battery levels, charging status, and energy consumption. This necessity creates a demand for intuitive touch-screen systems that can provide real-time data and enhance user experience. Reports indicate that the EV market is projected to grow at a CAGR of over 20% in the coming years, which will likely propel the automotive touch-screen-control-systems market as manufacturers adapt their offerings to cater to this evolving landscape.

Increased Focus on Safety Features

The automotive touch-screen-control-systems market is increasingly driven by a heightened focus on safety features. Regulatory bodies and consumers alike are demanding systems that enhance vehicle safety through intuitive interfaces. Touch-screen systems that provide easy access to critical information, such as navigation and vehicle diagnostics, are becoming essential. Moreover, features like emergency assistance and collision avoidance systems are often integrated into these touch-screen interfaces. As safety regulations become more stringent, manufacturers are compelled to develop touch-screen systems that comply with these standards, thereby expanding the automotive touch-screen-control-systems market. This focus on safety is likely to influence design and functionality in the coming years.

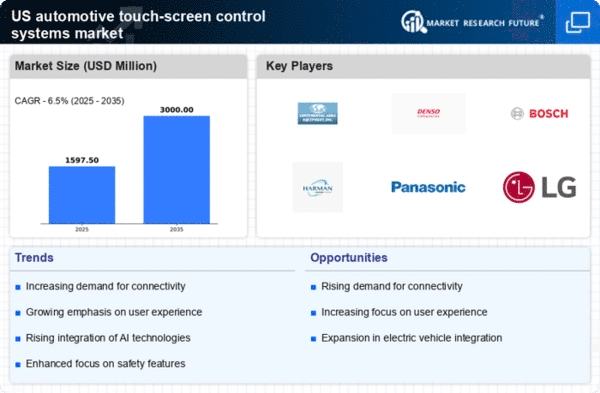

Rising Consumer Demand for Connectivity

The automotive touch-screen-control-systems market is experiencing a surge in consumer demand for enhanced connectivity features. As vehicles become increasingly integrated with smartphones and other devices, consumers expect seamless interaction with their vehicles. This trend is reflected in the growing preference for infotainment systems that offer real-time navigation, music streaming, and communication capabilities. According to recent data, approximately 70% of consumers prioritize connectivity features when purchasing a vehicle. This demand drives manufacturers to innovate and enhance their touch-screen systems, ensuring they meet consumer expectations. Consequently, the automotive touch-screen-control-systems market is likely to expand as manufacturers invest in advanced technologies to provide superior connectivity options.

Technological Advancements in User Interfaces

Technological advancements in user interfaces are a key driver for the automotive touch-screen-control-systems market. Innovations such as haptic feedback, voice recognition, and gesture control are transforming how users interact with their vehicles. These advancements not only enhance user experience but also improve safety by allowing drivers to access information without diverting their attention from the road. The integration of artificial intelligence into touch-screen systems is also gaining traction, enabling personalized experiences based on user preferences. As these technologies continue to evolve, the automotive touch-screen-control-systems market is expected to grow, with manufacturers striving to incorporate the latest innovations into their products.

Growing Investment in Autonomous Driving Technologies

The automotive touch-screen-control-systems market is poised for growth due to increasing investments in autonomous driving technologies. As manufacturers explore the potential of self-driving vehicles, the need for sophisticated touch-screen interfaces that can manage complex functionalities becomes apparent. These systems must provide users with real-time updates on vehicle status, navigation, and safety features, all while ensuring a user-friendly experience. The autonomous vehicle market is projected to witness substantial growth, with estimates suggesting a CAGR of over 15% in the next decade. This trend indicates that the automotive touch-screen-control-systems market will likely expand as manufacturers develop advanced interfaces to support the evolving demands of autonomous driving.