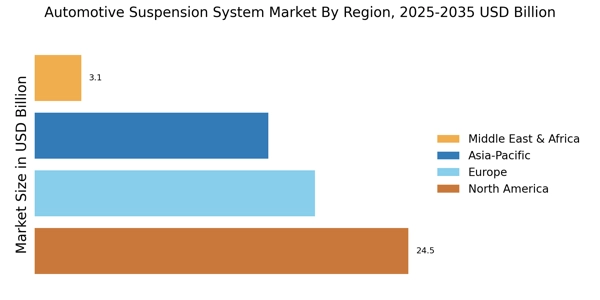

Growth of the Automotive Aftermarket

The automotive suspension system market is benefiting from the growth of the automotive aftermarket sector. As vehicle ownership increases, so does the demand for replacement parts and upgrades, including suspension systems. The aftermarket for automotive components is projected to grow steadily, driven by consumers seeking to enhance vehicle performance and longevity. In 2025, the aftermarket for suspension systems is expected to witness significant growth, as vehicle owners increasingly opt for high-performance and customized suspension solutions. This trend presents opportunities for manufacturers and suppliers within the automotive suspension system market to expand their offerings and cater to the evolving needs of consumers looking to improve their vehicles.

Increasing Demand for Electric Vehicles

The automotive suspension system sector is experiencing a notable shift due to the increasing demand for electric vehicles (EVs). As manufacturers pivot towards EV production, the need for advanced suspension systems that can accommodate the unique weight distribution and handling characteristics of electric drivetrains becomes paramount. In 2025, it is projected that the EV market will account for a substantial percentage of total vehicle sales, thereby driving innovations in suspension technology. This transition necessitates the development of lightweight and efficient suspension systems that enhance vehicle performance while ensuring passenger comfort. Consequently, the Vehicle Suspension System Market is likely to witness significant growth as manufacturers invest in research and development to meet these evolving demands.

Regulatory Standards and Safety Requirements

The global automotive suspension system market is significantly influenced by stringent regulatory standards and safety requirements imposed by various authorities. These regulations often mandate enhanced vehicle stability, ride comfort, and safety features, compelling manufacturers to innovate and upgrade their suspension systems. For instance, the implementation of advanced driver-assistance systems (ADAS) necessitates the integration of sophisticated suspension technologies that can adapt to varying road conditions. As safety regulations become more rigorous, the automotive suspension industry is expected to expand, with companies focusing on developing compliant and high-performance suspension solutions that not only meet but exceed these standards.

Technological Advancements in Suspension Systems

The automotive suspension system industry is poised for growth due to rapid technological advancements in suspension systems. Innovations such as active and semi-active suspension systems are gaining traction, offering improved ride quality and handling characteristics. These systems utilize sensors and electronic controls to adjust the suspension settings in real-time, enhancing vehicle performance. As of 2025, the market for advanced suspension technologies is projected to grow at a considerable rate, driven by consumer demand for enhanced driving experiences. Manufacturers are increasingly investing in research and development to create cutting-edge suspension solutions that cater to the evolving preferences of consumers, thereby propelling the suspension system market forward.

Rising Consumer Preference for Comfort and Performance

The automotive suspension system industry is significantly impacted by the rising consumer preference for comfort and performance in vehicles. As consumers become more discerning, they seek vehicles that offer superior ride quality and handling. This trend is prompting manufacturers to invest in advanced suspension technologies that enhance both comfort and performance. In 2025, it is anticipated that a considerable segment of the market will prioritize vehicles equipped with sophisticated suspension systems that provide a smooth driving experience. Consequently, the Automotive Suspension System Industry is likely to expand as manufacturers respond to these consumer demands by developing innovative suspension solutions that cater to the desire for enhanced comfort and performance.