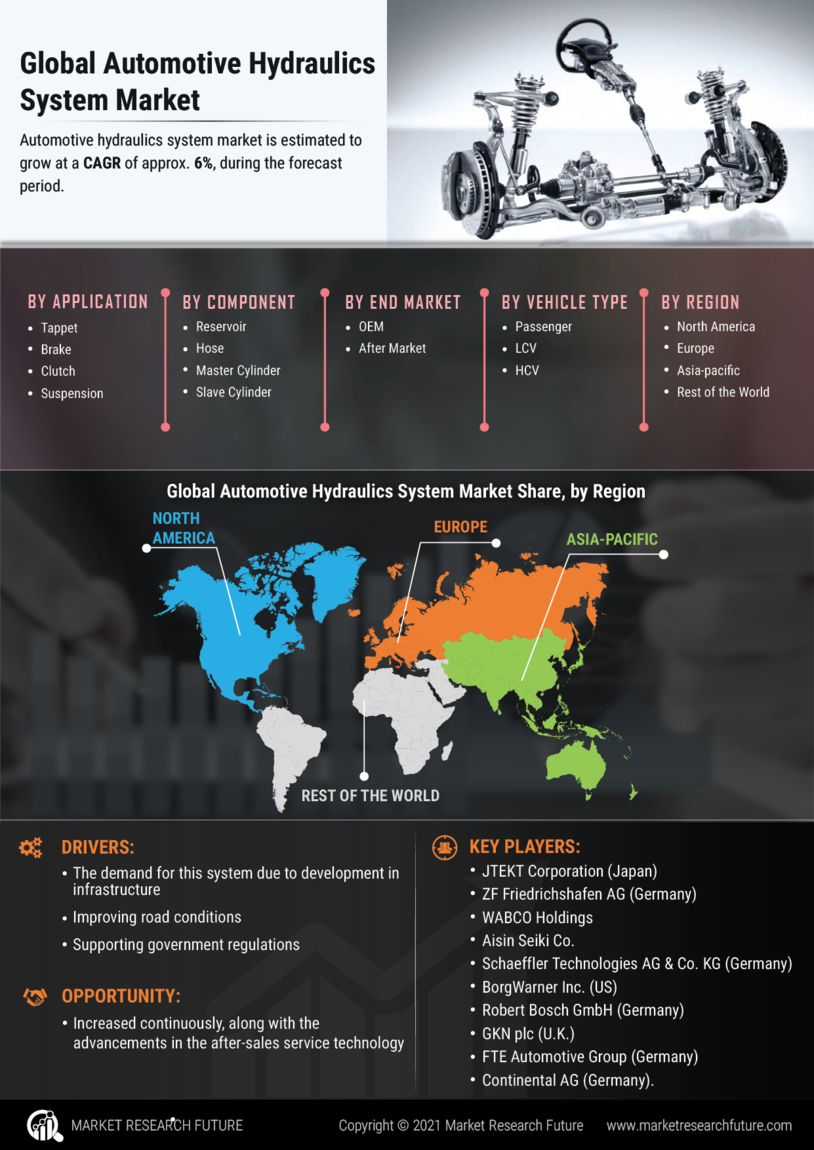

Rising Demand for Fuel Efficiency

The Automotive Hydraulics System Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become increasingly conscious of fuel costs and environmental impacts, automakers are compelled to innovate. Hydraulic systems play a crucial role in enhancing vehicle performance and efficiency. For instance, advanced hydraulic systems can optimize power distribution, thereby reducing fuel consumption. According to recent data, vehicles equipped with sophisticated hydraulic systems can achieve up to 15% better fuel efficiency compared to traditional systems. This trend is likely to drive investments in hydraulic technologies, as manufacturers seek to meet regulatory standards and consumer expectations.

Increasing Vehicle Production Rates

The Automotive Hydraulics System Market is closely linked to the overall production rates of vehicles. As manufacturers ramp up production to meet rising consumer demand, the need for efficient hydraulic systems becomes paramount. In recent years, vehicle production has seen a steady increase, with estimates suggesting a production rate of over 90 million units annually. This growth directly correlates with the demand for hydraulic systems, as they are integral to various vehicle functions, including braking and steering. Consequently, the market for automotive hydraulics is expected to expand, driven by the increasing volume of vehicles on the road.

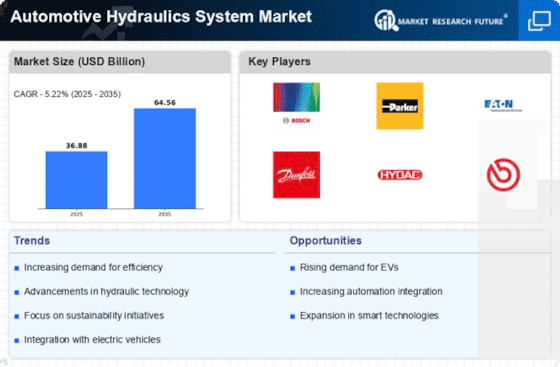

Growth of the Electric Vehicle Segment

The Automotive Hydraulics System Market is witnessing a transformation due to the growth of the electric vehicle segment. As electric vehicles (EVs) gain traction, the integration of hydraulic systems remains essential for various functionalities, including braking and suspension. The shift towards EVs is projected to increase the demand for lightweight and efficient hydraulic systems that can complement electric drivetrains. Market analysts suggest that the EV segment could account for a substantial portion of the automotive market by 2030, thereby driving innovations in hydraulic technologies tailored for electric applications. This evolution presents both challenges and opportunities for manufacturers in the hydraulic systems sector.

Regulatory Compliance and Safety Standards

Regulatory compliance is a significant driver in the Automotive Hydraulics System Market. Governments worldwide are implementing stringent safety and environmental regulations that necessitate the use of advanced hydraulic systems. These regulations often mandate the incorporation of hydraulic technologies that enhance vehicle safety, such as anti-lock braking systems (ABS) and electronic stability control (ESC). As manufacturers strive to comply with these regulations, the demand for innovative hydraulic solutions is likely to increase. This trend not only ensures safer vehicles but also propels the market forward, as companies invest in research and development to meet evolving standards.

Technological Advancements in Hydraulic Systems

Technological advancements are significantly shaping the Automotive Hydraulics System Market. Innovations such as variable displacement pumps and advanced control systems are enhancing the performance and reliability of hydraulic systems. These technologies not only improve vehicle handling and safety but also contribute to overall efficiency. The integration of smart sensors and IoT capabilities allows for real-time monitoring and adjustments, which can lead to improved performance metrics. As a result, the market is projected to grow at a compound annual growth rate of approximately 6% over the next five years, driven by the need for more sophisticated hydraulic solutions.