Shift Towards Electrification

The Automotive Steer-by-Wire System Market is closely linked to the ongoing shift towards electrification in the automotive sector. As manufacturers increasingly adopt electric vehicles, the need for lightweight and efficient steering systems becomes paramount. Steer-by-wire technology eliminates the need for traditional mechanical linkages, thereby reducing weight and enhancing energy efficiency. This transition is expected to drive the market, with estimates suggesting that the steer-by-wire segment could account for over 30% of the steering system market by 2030. Additionally, the compatibility of steer-by-wire systems with electric powertrains allows for more flexible vehicle designs, further promoting their adoption in the electrified vehicle landscape.

Focus on Safety and Regulation

The Automotive Steer-by-Wire System Market is significantly influenced by the increasing focus on safety and regulatory standards. Governments and regulatory bodies are implementing stringent safety requirements for vehicles, which necessitate the adoption of advanced steering technologies. Steer-by-wire systems offer enhanced safety features, such as automatic lane-keeping and collision avoidance, which align with these regulatory trends. Data indicates that vehicles equipped with steer-by-wire technology are likely to meet or exceed safety standards more effectively than traditional systems. As a result, manufacturers are investing heavily in steer-by-wire technology to comply with evolving regulations, thereby propelling market growth.

Consumer Demand for Enhanced Driving Experience

The Automotive Steer-by-Wire System Market is also driven by the growing consumer demand for enhanced driving experiences. Modern drivers are increasingly seeking vehicles that offer superior handling, comfort, and customization options. Steer-by-wire systems provide the flexibility to adjust steering response and feel, catering to individual preferences. This customization is appealing to consumers, particularly in the luxury vehicle segment, where personalized driving experiences are highly valued. Market analysis suggests that the demand for vehicles with advanced steering technologies could lead to a 20% increase in steer-by-wire system adoption in the coming years, as manufacturers strive to meet consumer expectations.

Integration with Autonomous Driving Technologies

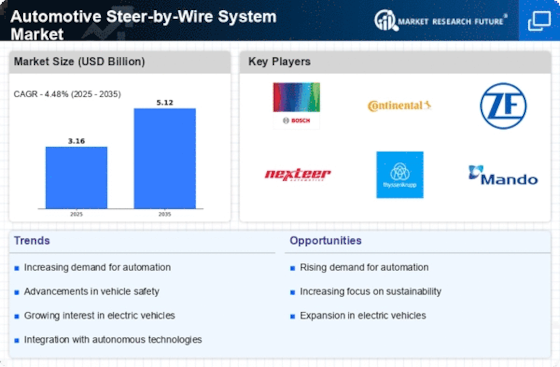

The Automotive Steer-by-Wire System Market is poised for growth due to its integration with autonomous driving technologies. As the automotive industry moves towards automation, steer-by-wire systems are becoming essential components in the development of self-driving vehicles. These systems facilitate precise control and responsiveness, which are critical for the safe operation of autonomous vehicles. Current projections indicate that the market for steer-by-wire systems in autonomous vehicles could expand by over 40% by 2030. This integration not only enhances the functionality of autonomous systems but also aligns with the broader trend of increasing automation in the automotive sector.

Technological Advancements in Automotive Steer-by-Wire Systems

The Automotive Steer-by-Wire System Market is experiencing a surge in technological advancements that enhance vehicle performance and driver experience. Innovations such as improved sensor technologies and advanced algorithms for steering control are becoming increasingly prevalent. These advancements not only improve the precision of steering but also contribute to the overall safety of vehicles. According to recent data, the integration of steer-by-wire systems is projected to increase by approximately 25% over the next five years, driven by the demand for more responsive and adaptable vehicle dynamics. Furthermore, the development of artificial intelligence in steering systems is likely to revolutionize how vehicles interact with drivers, making the steering process more intuitive and user-friendly.