Enhanced Security Features

Security remains a paramount concern in the Automotive Smart Key Market. With the rise in vehicle thefts and unauthorized access, manufacturers are increasingly focusing on developing smart keys with enhanced security features. These may include biometric authentication, encrypted communication, and advanced anti-theft mechanisms. Data indicates that the market for automotive security systems is expected to witness substantial growth, driven by consumer demand for safer vehicles. As smart keys evolve to incorporate these sophisticated security measures, they are likely to become indispensable in the automotive sector, further solidifying their position within the Automotive Smart Key Market.

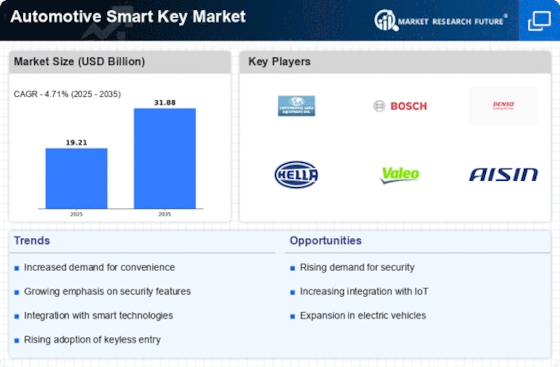

Growing Demand for Electric Vehicles

The shift towards electric vehicles (EVs) is significantly influencing the Automotive Smart Key Market. As more consumers opt for EVs, the need for smart keys that cater specifically to these vehicles is becoming apparent. Smart keys designed for EVs often include features such as remote charging control and battery status monitoring, which enhance the user experience. Market analysis suggests that the EV segment is expected to grow at a rapid pace, with smart keys playing a crucial role in this transition. This trend indicates a promising future for the Automotive Smart Key Market, as manufacturers adapt to the evolving needs of the automotive landscape.

Integration with Advanced Connectivity Features

The Automotive Smart Key Market is experiencing a notable shift towards advanced connectivity features. As vehicles become increasingly integrated with smart technology, the demand for smart keys that can seamlessly connect with mobile devices and other smart systems is rising. This integration allows for functionalities such as remote access, vehicle tracking, and personalized settings, enhancing user convenience. According to recent data, the market for connected car technologies is projected to grow significantly, with smart keys playing a pivotal role in this evolution. The ability to control various vehicle functions through a smartphone app is likely to drive consumer interest, thereby propelling the Automotive Smart Key Market forward.

Technological Advancements in Keyless Entry Systems

Technological advancements are playing a crucial role in shaping the Automotive Smart Key Market. Innovations in keyless entry systems, such as passive entry and start systems, are enhancing the functionality and appeal of smart keys. These systems allow users to unlock and start their vehicles without physically using a key, thereby improving convenience. Market Research Future indicates that the demand for keyless entry systems is on the rise, driven by consumer preferences for seamless access to their vehicles. As technology continues to evolve, the Automotive Smart Key Market is expected to adapt, leading to the development of even more sophisticated smart key solutions.

Consumer Preference for Convenience and User Experience

In the Automotive Smart Key Market, consumer preferences are increasingly leaning towards convenience and enhanced user experience. Smart keys that offer features such as keyless entry, remote start, and personalized settings are becoming more desirable among consumers. This shift is reflected in market data, which shows a growing trend in the adoption of smart keys as part of the overall vehicle experience. As manufacturers strive to meet these evolving consumer demands, the Automotive Smart Key Market is likely to see continued innovation and development, ensuring that smart keys remain a vital component of modern vehicles.