Increased Adoption of Electric Vehicles

The increased adoption of electric vehicles (EVs) is a significant driver for the Automotive Digital Key Market. As the automotive landscape shifts towards electrification, manufacturers are incorporating digital key technologies to enhance the user experience. EVs often come equipped with advanced connectivity features, making them compatible with digital key systems. Data indicates that the EV market is anticipated to grow at a rate of 20% annually, which correlates with the rising demand for digital key solutions. This trend suggests that as more consumers transition to electric vehicles, the need for seamless access and control through digital keys will likely increase. Consequently, the Automotive Digital Key Market stands to benefit from this shift, as manufacturers seek to integrate innovative solutions that cater to the evolving preferences of EV owners.

Rising Demand for Contactless Solutions

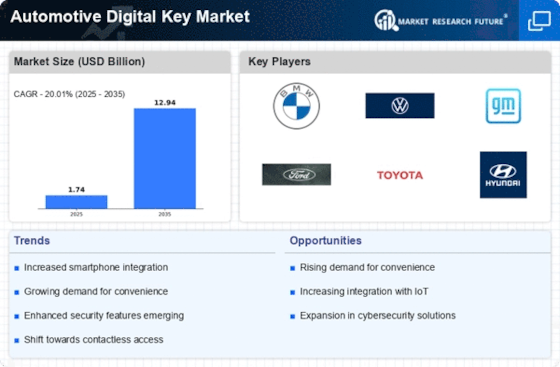

The Automotive Digital Key Market is experiencing a notable surge in demand for contactless solutions, driven by the increasing consumer preference for convenience and safety. As more individuals seek to minimize physical interactions, the adoption of digital keys, which allow users to unlock and start their vehicles via smartphones, is likely to rise. According to recent data, the market for contactless automotive solutions is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This trend indicates a shift in consumer behavior, where the ease of access and enhanced user experience are prioritized. Consequently, automotive manufacturers are investing in the development of advanced digital key technologies to meet this growing demand, thereby propelling the Automotive Digital Key Market forward.

Regulatory Support for Digital Innovations

Regulatory support for digital innovations is emerging as a crucial driver for the Automotive Digital Key Market. Governments are increasingly recognizing the importance of digital solutions in enhancing vehicle security and user convenience. Initiatives aimed at promoting smart mobility and reducing carbon footprints are encouraging manufacturers to adopt digital key technologies. Recent policy frameworks suggest that countries are investing in infrastructure that supports the integration of digital solutions in the automotive sector. This regulatory backing not only fosters innovation but also creates a conducive environment for the growth of the Automotive Digital Key Market. As regulations evolve to support digital advancements, manufacturers are likely to accelerate their efforts in developing and implementing digital key technologies.

Growing Focus on User Experience and Convenience

A growing focus on user experience and convenience is shaping the Automotive Digital Key Market. Consumers today expect seamless interactions with their vehicles, and digital keys offer a level of convenience that traditional keys cannot match. Features such as remote access, key sharing, and personalized settings enhance the overall driving experience. Market Research Future indicates that approximately 70% of consumers are willing to pay a premium for vehicles equipped with advanced digital key functionalities. This willingness to invest in convenience underscores the importance of user-centric design in the automotive sector. As manufacturers prioritize the development of intuitive digital key systems, the Automotive Digital Key Market is likely to witness substantial growth, driven by the demand for enhanced user experiences.

Technological Advancements in Automotive Security

Technological advancements in automotive security are significantly influencing the Automotive Digital Key Market. The integration of advanced encryption methods and biometric authentication systems enhances the security of digital keys, making them more appealing to consumers. As vehicle theft becomes a growing concern, the need for robust security features is paramount. Recent statistics suggest that vehicles equipped with digital key technology experience a reduction in theft rates by up to 30%. This heightened security not only protects the vehicle but also instills confidence in consumers regarding the safety of their assets. As manufacturers continue to innovate and improve security measures, the Automotive Digital Key Market is expected to expand, attracting more users who prioritize safety and reliability.