Increased Focus on User Experience

User experience is becoming a central focus in the automotive smart-key market. As competition intensifies among automakers, there is a growing emphasis on providing a superior user experience through innovative smart-key features. This includes personalized settings, such as seat adjustments and climate control, which can be accessed via the smart key. Research indicates that 75% of consumers consider user experience a critical factor when purchasing a vehicle. Consequently, the automotive smart-key market is likely to see continued investment in developing user-friendly interfaces and features that cater to consumer preferences, thereby driving market growth.

Rising Consumer Demand for Convenience

The automotive smart-key market is experiencing a notable surge in consumer demand for convenience and enhanced user experience. As vehicle owners increasingly seek seamless access to their cars, smart keys offer features such as keyless entry and remote start, which are becoming essential. According to recent data, approximately 60% of new vehicles sold in the US are equipped with smart-key technology, reflecting a shift in consumer preferences. This trend is likely to continue as manufacturers integrate advanced functionalities into smart keys, such as smartphone connectivity and biometric authentication. The automotive smart-key market is thus poised for growth, driven by the desire for convenience and the adoption of innovative technologies that enhance the overall driving experience.

Growing Popularity of Connected Vehicles

The rise of connected vehicles is a crucial driver for the automotive smart-key market. As vehicles become more integrated with the Internet of Things (IoT), smart keys are evolving to offer enhanced connectivity features. This includes functionalities such as remote vehicle monitoring and control via mobile applications. Current estimates indicate that the connected vehicle market in the US is expected to grow at a CAGR of 20% over the next five years, which will likely bolster the demand for smart keys. The automotive smart-key market is thus positioned to benefit from this trend, as consumers increasingly seek integrated solutions that enhance their driving experience.

Integration of Advanced Security Features

Security concerns remain a pivotal driver in the automotive smart-key market. With rising incidents of vehicle theft, manufacturers are increasingly incorporating advanced security features into smart keys, such as encrypted signals and two-factor authentication. This integration not only enhances vehicle security but also instills consumer confidence in smart-key technology. Recent statistics indicate that vehicles equipped with smart keys experience a 30% reduction in theft rates compared to traditional keys. As the automotive smart-key market evolves, the emphasis on security will likely lead to further innovations, making smart keys a preferred choice for consumers prioritizing safety.

Technological Innovations in Automotive Design

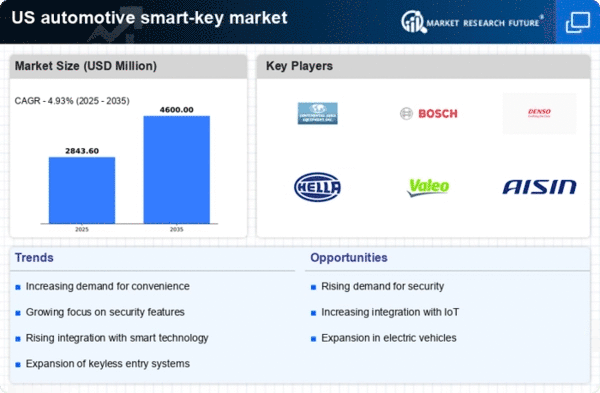

The automotive smart-key market is significantly influenced by ongoing technological innovations in automotive design. As vehicles become more technologically advanced, the demand for compatible smart-key systems increases. Features such as remote diagnostics, vehicle tracking, and integration with smart home systems are becoming commonplace. In fact, projections suggest that by 2027, the market for smart keys could reach $5 billion in the US alone, driven by these technological advancements. The automotive smart-key market is thus adapting to these changes, ensuring that smart keys not only meet current consumer expectations but also anticipate future technological trends.